Western Carolina University (21)

View all

- Canton Champion Fibre Company (2308)

- Cherokee Traditions (291)

- Civil War in Southern Appalachia (165)

- Craft Revival (1942)

- George Masa Collection (135)

- Great Smoky Mountains - A Park for America (2901)

- Highlights from Western Carolina University (422)

- Horace Kephart (941)

- Journeys Through Jackson (159)

- LGBTQIA+ Archive of Jackson County (85)

- Oral Histories of Western North Carolina (314)

- Picturing Appalachia (6798)

- Stories of Mountain Folk (413)

- Travel Western North Carolina (153)

- Western Carolina University Fine Art Museum Vitreograph Collection (129)

- Western Carolina University Herbarium (92)

- Western Carolina University: Making Memories (738)

- Western Carolina University Publications (2491)

- Western Carolina University Restricted Electronic Theses and Dissertations (146)

- Western North Carolina Regional Maps (71)

- World War II in Southern Appalachia (131)

University of North Carolina Asheville (6)

View all

- Allanstand Cottage Industries (62)

- Appalachian National Park Association (53)

- Bennett, Kelly, 1890-1974 (1463)

- Berry, Walter (76)

- Brasstown Carvers (40)

- Carver, George Washington, 1864?-1943 (26)

- Cathey, Joseph, 1803-1874 (1)

- Champion Fibre Company (233)

- Champion Paper and Fibre Company (297)

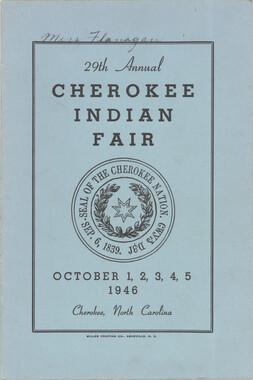

- Cherokee Indian Fair Association (16)

- Cherokee Language Program (22)

- Crowe, Amanda (40)

- Edmonston, Thomas Benton, 1842-1907 (7)

- Ensley, A. L. (Abraham Lincoln), 1865-1948 (275)

- Fromer, Irving Rhodes, 1913-1994 (70)

- George Butz (BFS 1907) (46)

- Goodrich, Frances Louisa (120)

- Grant, George Alexander, 1891-1964 (96)

- Heard, Marian Gladys (60)

- Kephart, Calvin, 1883-1969 (15)

- Kephart, Horace, 1862-1931 (313)

- Kephart, Laura, 1862-1954 (39)

- Laney, Gideon Thomas, 1889-1976 (439)

- Masa, George, 1881-1933 (61)

- McElhinney, William Julian, 1896-1953 (44)

- Niggli, Josephina, 1910-1983 (10)

- North Carolina Park Commission (105)

- Osborne, Kezia Stradley (9)

- Owens, Samuel Robert, 1918-1995 (11)

- Penland Weavers and Potters (36)

- Roberts, Vivienne (15)

- Roth, Albert, 1890-1974 (142)

- Schenck, Carl Alwin, 1868-1955 (1)

- Sherrill's Photography Studio (2565)

- Southern Highland Handicraft Guild (127)

- Southern Highlanders, Inc. (71)

- Stalcup, Jesse Bryson (46)

- Stearns, I. K. (213)

- Thompson, James Edward, 1880-1976 (226)

- United States. Indian Arts and Crafts Board (130)

- USFS (683)

- Vance, Zebulon Baird, 1830-1894 (1)

- Weaver, Zebulon, 1872-1948 (58)

- Western Carolina College (230)

- Western Carolina Teachers College (282)

- Western Carolina University (2008)

- Western Carolina University. Mountain Heritage Center (18)

- Whitman, Walt, 1819-1892 (10)

- Wilburn, Hiram Coleman, 1880-1967 (73)

- Williams, Isadora (3)

- Cain, Doreyl Ammons (0)

- Crittenden, Lorraine (0)

- Rhodes, Judy (0)

- Smith, Edward Clark (0)

- Appalachian Region, Southern (2693)

- Asheville (N.C.) (1936)

- Avery County (N.C.) (26)

- Blount County (Tenn.) (195)

- Buncombe County (N.C.) (1672)

- Cherokee County (N.C.) (283)

- Clay County (N.C.) (556)

- Graham County (N.C.) (236)

- Great Smoky Mountains National Park (N.C. and Tenn.) (519)

- Haywood County (N.C.) (3569)

- Henderson County (N.C.) (70)

- Jackson County (N.C.) (4913)

- Knox County (Tenn.) (35)

- Knoxville (Tenn.) (13)

- Lake Santeetlah (N.C.) (10)

- Macon County (N.C.) (420)

- Madison County (N.C.) (215)

- McDowell County (N.C.) (39)

- Mitchell County (N.C.) (132)

- Polk County (N.C.) (35)

- Qualla Boundary (982)

- Rutherford County (N.C.) (76)

- Swain County (N.C.) (2182)

- Transylvania County (N.C.) (270)

- Watauga County (N.C.) (12)

- Waynesville (N.C.) (86)

- Yancey County (N.C.) (72)

- Aerial Photographs (3)

- Aerial Views (60)

- Albums (books) (4)

- Articles (1)

- Artifacts (object Genre) (228)

- Bibliographies (1)

- Biography (general Genre) (2)

- Cards (information Artifacts) (38)

- Clippings (information Artifacts) (191)

- Copybooks (instructional Materials) (3)

- Crafts (art Genres) (622)

- Depictions (visual Works) (21)

- Design Drawings (1)

- Drawings (visual Works) (185)

- Envelopes (73)

- Exhibitions (events) (1)

- Facsimiles (reproductions) (1)

- Fiction (general Genre) (4)

- Financial Records (12)

- Fliers (printed Matter) (67)

- Glass Plate Negatives (381)

- Guidebooks (2)

- Internegatives (10)

- Interviews (815)

- Land Surveys (102)

- Letters (correspondence) (1013)

- Manuscripts (documents) (618)

- Maps (documents) (177)

- Memorandums (25)

- Minutes (administrative Records) (59)

- Negatives (photographs) (6090)

- Newsletters (1290)

- Newspapers (2)

- Notebooks (8)

- Occupation Currency (1)

- Paintings (visual Works) (1)

- Pen And Ink Drawings (1)

- Periodicals (193)

- Personal Narratives (10)

- Photographs (12976)

- Plans (maps) (1)

- Poetry (5)

- Portraits (4568)

- Postcards (329)

- Programs (documents) (181)

- Publications (documents) (2443)

- Questionnaires (65)

- Relief Prints (26)

- Sayings (literary Genre) (1)

- Scrapbooks (282)

- Sheet Music (2)

- Slides (photographs) (402)

- Songs (musical Compositions) (2)

- Sound Recordings (796)

- Specimens (92)

- Speeches (documents) (18)

- Tintypes (photographs) (8)

- Transcripts (322)

- Video Recordings (physical Artifacts) (23)

- Text Messages (0)

- A.L. Ensley Collection (275)

- Appalachian Industrial School Records (7)

- Appalachian National Park Association Records (336)

- Axley-Meroney Collection (2)

- Bayard Wootten Photograph Collection (20)

- Bethel Rural Community Organization Collection (7)

- Blumer Collection (5)

- C.W. Slagle Collection (20)

- Canton Area Historical Museum (2110)

- Carlos C. Campbell Collection (462)

- Cataloochee History Project (64)

- Cherokee Studies Collection (4)

- Daisy Dame Photograph Album (5)

- Daniel Boone VI Collection (1)

- Doris Ulmann Photograph Collection (112)

- Elizabeth H. Lasley Collection (1)

- Elizabeth Woolworth Szold Fleharty Collection (4)

- Frank Fry Collection (95)

- George Masa Collection (173)

- Gideon Laney Collection (452)

- Hazel Scarborough Collection (2)

- Hiram C. Wilburn Papers (28)

- Historic Photographs Collection (236)

- Horace Kephart Collection (861)

- Humbard Collection (33)

- Hunter and Weaver Families Collection (1)

- I. D. Blumenthal Collection (4)

- Isadora Williams Collection (4)

- Jesse Bryson Stalcup Collection (47)

- Jim Thompson Collection (224)

- John B. Battle Collection (7)

- John C. Campbell Folk School Records (80)

- John Parris Collection (6)

- Judaculla Rock project (2)

- Kelly Bennett Collection (1482)

- Love Family Papers (11)

- Major Wiley Parris Civil War Letters (3)

- Map Collection (12)

- McFee-Misemer Civil War Letters (34)

- Mountain Heritage Center Collection (4)

- Norburn - Robertson - Thomson Families Collection (44)

- Pauline Hood Collection (7)

- Pre-Guild Collection (2)

- Qualla Arts and Crafts Mutual Collection (12)

- R.A. Romanes Collection (681)

- Rosser H. Taylor Collection (1)

- Samuel Robert Owens Collection (94)

- Sara Madison Collection (144)

- Sherrill Studio Photo Collection (2558)

- Smoky Mountains Hiking Club Collection (616)

- Stories of Mountain Folk - Radio Programs (374)

- The Reporter, Western Carolina University (510)

- Venoy and Elizabeth Reed Collection (16)

- WCU Gender and Sexuality Oral History Project (32)

- WCU Mountain Heritage Center Oral Histories (25)

- WCU Oral History Collection - Mountain People, Mountain Lives (71)

- WCU Students Newspapers Collection (1923)

- Western North Carolina Tomorrow Black Oral History Project (69)

- William Williams Stringfield Collection (2)

- Zebulon Weaver Collection (109)

- African Americans (390)

- Appalachian Trail (35)

- Artisans (521)

- Cherokee art (84)

- Cherokee artists -- North Carolina (10)

- Cherokee language (21)

- Cherokee pottery (101)

- Cherokee women (208)

- Church buildings (190)

- Civilian Conservation Corps (U.S.) (111)

- College student newspapers and periodicals (2012)

- Dams (107)

- Dance (1023)

- Education (222)

- Floods (61)

- Folk music (1015)

- Forced removal, 1813-1903 (2)

- Forest conservation (220)

- Forests and forestry (1195)

- Gender nonconformity (4)

- Great Smoky Mountains National Park (N.C. and Tenn.) (181)

- Hunting (45)

- Landscape photography (25)

- Logging (119)

- Maps (83)

- Mines and mineral resources (8)

- North Carolina -- Maps (18)

- Paper industry (38)

- Postcards (255)

- Pottery (135)

- Railroad trains (72)

- Rural electrification -- North Carolina, Western (3)

- School integration -- Southern States (2)

- Segregation -- North Carolina, Western (5)

- Slavery (5)

- Sports (452)

- Storytelling (243)

- Waterfalls -- Great Smoky Mountains (N.C. and Tenn.) (66)

- Weaving -- Appalachian Region, Southern (280)

- Wood-carving -- Appalachian Region, Southern (328)

- World War, 1939-1945 (173)

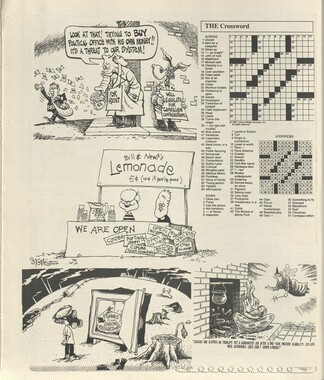

Western Carolinian Volume 69 Number 12

Item

Item’s are ‘child’ level descriptions to ‘parent’ objects, (e.g. one page of a whole book).

-

-

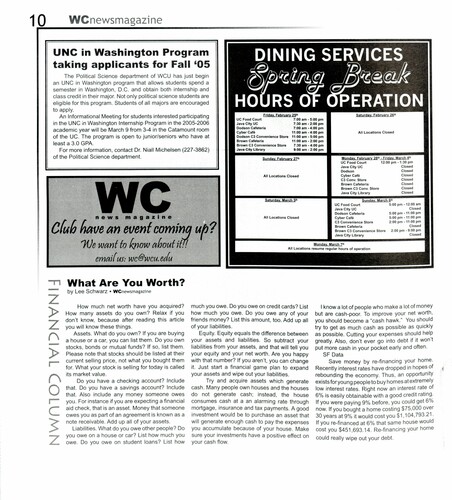

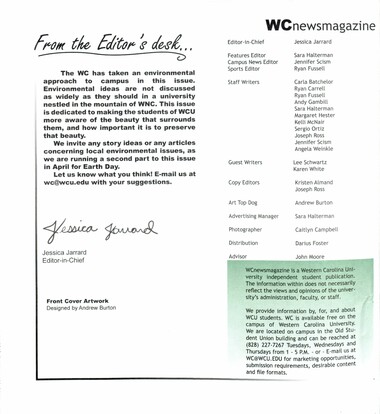

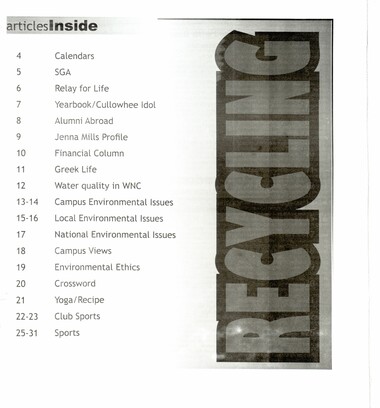

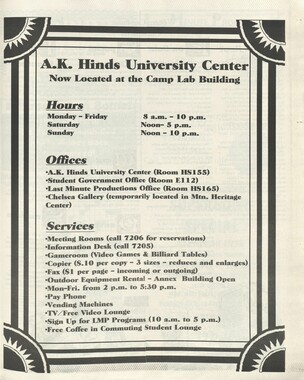

10 WCnewsmagazine UNC in Washington Program taking applicants for Fall 05 The Political Science department of WCU has just begin an UNC in Washington program that allows students spend a semester in Washington, D.C. and obtain both internship and class credit in their major. Not only political science students are eligible for this program. Students of all majors are encouraged to apply. An Informational Meeting for students interested participating in the UNC in Washington Internship Program in the 2005-2006 DINING SERVICES Sper ce HOURS OF OPERATION r Java City UC Dodson Cafeteria 7:00 am - 5:00 pm 7:30 am - 2:00 pm Tl NWN10OD IVWIDNVN senses academic year will be March 9 from 3-4 in the Catamount room of the UC. The program is open to junior/seniors who have at least a 3.0 GPA. For more information, contact Dr. Niall Michelsen (227-3862) of the Political Science department. What Are You Worth? by Lee Schwarz * WCnewsmagazine How much net worth have you acquired? How many assets do you own? Relax if you dont know, because after reading this article you will know these things. Assets. What do you own? If you are buying a house or a car, you can list them. Do you own stocks, bonds or mutual funds? If so, list them. Please note that stocks should be listed at their current selling price, not what you bought them for. What your stock is selling for today is called its market value. Do you have a checking account? Include that. Do you have a savings account? Include that. Also include any money someone owes you. For instance if you are expecting a financial aid check, that is an asset. Money that someone owes you as part of an agreement is known as a note receivable. Add up all of your assets. Liabilities. What do you owe other people? Do you owe on a house or car? List how much you owe. Do you owe on student loans? List how Cyber Caf Brown Cafeteria Brown C3 Convenience Store Java City Library Sunday, February 27" All Locations Closed Saturday, March 5 All Locations Closed 7:00 am - 4:00 pm 11:00 am - 4:00 pm Dodson C3 Convenience Store 11:00 am - 5:00 pm 11:00 am - 2:00 pm 7:30 am - 4:00 pm 9:00 am - 2:00 pm All Locations Closed th. 12:00 pm - 1:30 pm Closed Closed Closed Closed Closed Closed Closed UC Food Court Java City UC Dodson Cyber Caf C3 Conv. Store Brown Cafeteria Brown C3 Conv. Store Java City Library ri 5:00 pm - 12:00 am Closed 5:00 pm - 11:00 pm 5:00 pm - 11:00 pm 2:00 pm - 11:00 pm Closed 2:00 pm - 9:00 pm Closed UC Food Court Java City UC Dodson Cafeteria Cyber Caf C3 Convenience Store Brown Cafeteria Brown C3 Convenience Store Java City Library Monday, March 7" All Locations resume regular hours of operation much you owe. Do you owe on credit cards? List how much you owe. Do you owe any of your friends money? List this amount, too. Add up all of your liabilities. Equity. Equity equals the difference between your assets and liabilities. So subtract your liabilities from your assets, and that will tell you your equity and your net worth. Are you happy with that number? If you aren't, you can change it. Just start a financial game plan to expand your assets and wipe out your liabilities. Try and acquire assets which generate cash. Many people own houses and the houses do not generate cash; instead, the house consumes cash at a an alarming rate through mortgage, insurance and tax payments. A good investment would be to purchase an asset that will generate enough cash to pay the expenses you accumulate because of your house. Make sure your investments have a positive effect on your cash flow. | know a lot of people who make a lot of money but are cash-poor. To improve your net worth, you should become a cash hawk. You should try to get as much cash as possible as quickly as possible. Cutting your expenses should help greatly. Also, dont ever go into debt if it won't put more cash in your pocket early and often. SF Data Save money by re-financing your home. Recently interest rates have dropped in hopes of rebounding the economy. Thus, an opportunity exists for young people to buy homes at extremely low interest rates. Right now an interest rate of 6% is easily obtainable with a good credit rating. If you were paying 9% before, you could get 6% now. If you bought a home costing $75,000 over 30 years at 9% it would cost you $1,104,793.21. If you re-financed at 6% that same house would cost you $451,693.14. Re-financing your home could really wipe out your debt.

Object

Object’s are ‘parent’ level descriptions to ‘children’ items, (e.g. a book with pages).

-

The Western Carolinian is Western Carolina University's student-run newspaper. The paper was published as the Cullowhee Yodel from 1924 to 1931 before changing its name to The Western Carolinian in 1933.

-