Western Carolina University (20)

View all

- Canton Champion Fibre Company (2308)

- Cherokee Traditions (293)

- Civil War in Southern Appalachia (165)

- Craft Revival (1942)

- Great Smoky Mountains - A Park for America (2767)

- Highlights from Western Carolina University (430)

- Horace Kephart (941)

- Journeys Through Jackson (154)

- LGBTQIA+ Archive of Jackson County (26)

- Oral Histories of Western North Carolina (314)

- Picturing Appalachia (6772)

- Stories of Mountain Folk (413)

- Travel Western North Carolina (160)

- Western Carolina University Fine Art Museum Vitreograph Collection (129)

- Western Carolina University Herbarium (92)

- Western Carolina University: Making Memories (708)

- Western Carolina University Publications (2283)

- Western Carolina University Restricted Electronic Theses and Dissertations (146)

- Western North Carolina Regional Maps (71)

- World War II in Southern Appalachia (131)

University of North Carolina Asheville (6)

View all

- Allanstand Cottage Industries (62)

- Appalachian National Park Association (53)

- Bennett, Kelly, 1890-1974 (1388)

- Berry, Walter (76)

- Brasstown Carvers (40)

- Carver, George Washington, 1864?-1943 (26)

- Cathey, Joseph, 1803-1874 (1)

- Champion Fibre Company (233)

- Champion Paper and Fibre Company (297)

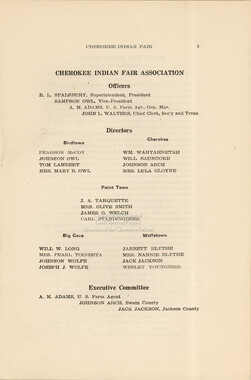

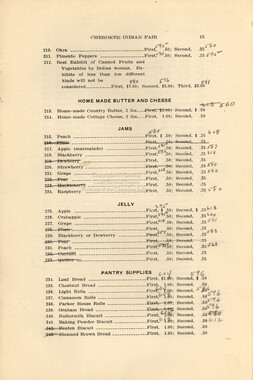

- Cherokee Indian Fair Association (16)

- Cherokee Language Program (22)

- Crowe, Amanda (40)

- Edmonston, Thomas Benton, 1842-1907 (7)

- Ensley, A. L. (Abraham Lincoln), 1865-1948 (275)

- Fromer, Irving Rhodes, 1913-1994 (70)

- George Butz (BFS 1907) (46)

- Goodrich, Frances Louisa (120)

- Grant, George Alexander, 1891-1964 (96)

- Heard, Marian Gladys (60)

- Kephart, Calvin, 1883-1969 (15)

- Kephart, Horace, 1862-1931 (313)

- Kephart, Laura, 1862-1954 (39)

- Laney, Gideon Thomas, 1889-1976 (439)

- Masa, George, 1881-1933 (61)

- McElhinney, William Julian, 1896-1953 (44)

- Niggli, Josephina, 1910-1983 (10)

- North Carolina Park Commission (105)

- Osborne, Kezia Stradley (9)

- Owens, Samuel Robert, 1918-1995 (11)

- Penland Weavers and Potters (36)

- Roberts, Vivienne (15)

- Roth, Albert, 1890-1974 (142)

- Schenck, Carl Alwin, 1868-1955 (1)

- Sherrill's Photography Studio (2565)

- Southern Highland Handicraft Guild (127)

- Southern Highlanders, Inc. (71)

- Stalcup, Jesse Bryson (46)

- Stearns, I. K. (213)

- Thompson, James Edward, 1880-1976 (226)

- United States. Indian Arts and Crafts Board (130)

- USFS (683)

- Vance, Zebulon Baird, 1830-1894 (1)

- Weaver, Zebulon, 1872-1948 (58)

- Western Carolina College (230)

- Western Carolina Teachers College (282)

- Western Carolina University (1794)

- Western Carolina University. Mountain Heritage Center (18)

- Whitman, Walt, 1819-1892 (10)

- Wilburn, Hiram Coleman, 1880-1967 (73)

- Williams, Isadora (3)

- Cain, Doreyl Ammons (0)

- Crittenden, Lorraine (0)

- Rhodes, Judy (0)

- Smith, Edward Clark (0)

- Appalachian Region, Southern (2399)

- Asheville (N.C.) (1917)

- Avery County (N.C.) (26)

- Blount County (Tenn.) (161)

- Buncombe County (N.C.) (1671)

- Cherokee County (N.C.) (283)

- Clay County (N.C.) (555)

- Graham County (N.C.) (233)

- Great Smoky Mountains National Park (N.C. and Tenn.) (510)

- Haywood County (N.C.) (3522)

- Henderson County (N.C.) (70)

- Jackson County (N.C.) (4692)

- Knox County (Tenn.) (25)

- Knoxville (Tenn.) (12)

- Lake Santeetlah (N.C.) (10)

- Macon County (N.C.) (420)

- Madison County (N.C.) (211)

- McDowell County (N.C.) (39)

- Mitchell County (N.C.) (132)

- Polk County (N.C.) (35)

- Qualla Boundary (981)

- Rutherford County (N.C.) (76)

- Swain County (N.C.) (2113)

- Transylvania County (N.C.) (247)

- Watauga County (N.C.) (12)

- Waynesville (N.C.) (73)

- Yancey County (N.C.) (72)

- Aerial Photographs (3)

- Aerial Views (60)

- Albums (books) (4)

- Articles (1)

- Artifacts (object Genre) (228)

- Bibliographies (1)

- Biography (general Genre) (2)

- Cards (information Artifacts) (38)

- Clippings (information Artifacts) (191)

- Crafts (art Genres) (622)

- Depictions (visual Works) (21)

- Design Drawings (1)

- Drawings (visual Works) (184)

- Envelopes (73)

- Facsimiles (reproductions) (1)

- Fiction (general Genre) (4)

- Financial Records (12)

- Fliers (printed Matter) (67)

- Glass Plate Negatives (381)

- Guidebooks (2)

- Internegatives (10)

- Interviews (812)

- Land Surveys (102)

- Letters (correspondence) (1013)

- Manuscripts (documents) (619)

- Maps (documents) (177)

- Memorandums (25)

- Minutes (administrative Records) (59)

- Negatives (photographs) (5835)

- Newsletters (1285)

- Newspapers (2)

- Occupation Currency (1)

- Paintings (visual Works) (1)

- Pen And Ink Drawings (1)

- Periodicals (193)

- Personal Narratives (10)

- Photographs (12976)

- Plans (maps) (1)

- Poetry (7)

- Portraits (1960)

- Postcards (329)

- Programs (documents) (151)

- Publications (documents) (2237)

- Questionnaires (65)

- Scrapbooks (282)

- Sheet Music (2)

- Slides (photographs) (402)

- Songs (musical Compositions) (2)

- Sound Recordings (796)

- Specimens (92)

- Speeches (documents) (15)

- Tintypes (photographs) (8)

- Transcripts (322)

- Video Recordings (physical Artifacts) (23)

- Vitreographs (129)

- Text Messages (0)

- A.L. Ensley Collection (275)

- Appalachian Industrial School Records (7)

- Appalachian National Park Association Records (336)

- Axley-Meroney Collection (2)

- Bayard Wootten Photograph Collection (20)

- Bethel Rural Community Organization Collection (7)

- Blumer Collection (5)

- C.W. Slagle Collection (20)

- Canton Area Historical Museum (2110)

- Carlos C. Campbell Collection (282)

- Cataloochee History Project (65)

- Cherokee Studies Collection (4)

- Daisy Dame Photograph Album (5)

- Daniel Boone VI Collection (1)

- Doris Ulmann Photograph Collection (112)

- Elizabeth H. Lasley Collection (1)

- Elizabeth Woolworth Szold Fleharty Collection (4)

- Frank Fry Collection (95)

- George Masa Collection (173)

- Gideon Laney Collection (452)

- Hazel Scarborough Collection (2)

- Hiram C. Wilburn Papers (28)

- Historic Photographs Collection (236)

- Horace Kephart Collection (861)

- Humbard Collection (33)

- Hunter and Weaver Families Collection (1)

- I. D. Blumenthal Collection (4)

- Isadora Williams Collection (4)

- Jesse Bryson Stalcup Collection (47)

- Jim Thompson Collection (224)

- John B. Battle Collection (7)

- John C. Campbell Folk School Records (80)

- John Parris Collection (6)

- Judaculla Rock project (2)

- Kelly Bennett Collection (1407)

- Love Family Papers (11)

- Major Wiley Parris Civil War Letters (3)

- Map Collection (12)

- McFee-Misemer Civil War Letters (34)

- Mountain Heritage Center Collection (4)

- Norburn - Robertson - Thomson Families Collection (44)

- Pauline Hood Collection (7)

- Pre-Guild Collection (2)

- Qualla Arts and Crafts Mutual Collection (12)

- R.A. Romanes Collection (681)

- Rosser H. Taylor Collection (1)

- Samuel Robert Owens Collection (94)

- Sara Madison Collection (144)

- Sherrill Studio Photo Collection (2558)

- Smoky Mountains Hiking Club Collection (616)

- Stories of Mountain Folk - Radio Programs (374)

- The Reporter, Western Carolina University (510)

- Venoy and Elizabeth Reed Collection (16)

- WCU Gender and Sexuality Oral History Project (32)

- WCU Mountain Heritage Center Oral Histories (25)

- WCU Oral History Collection - Mountain People, Mountain Lives (71)

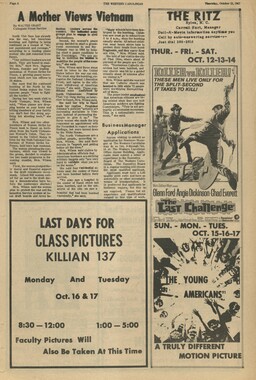

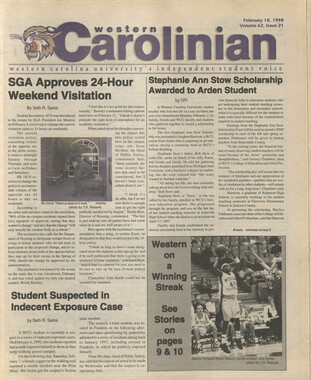

- WCU Students Newspapers Collection (1744)

- Western North Carolina Tomorrow Black Oral History Project (69)

- William Williams Stringfield Collection (2)

- Zebulon Weaver Collection (109)

- African Americans (390)

- Appalachian Trail (35)

- Artisans (521)

- Cherokee art (84)

- Cherokee artists -- North Carolina (10)

- Cherokee language (21)

- Cherokee pottery (101)

- Cherokee women (208)

- Church buildings (167)

- Civilian Conservation Corps (U.S.) (110)

- College student newspapers and periodicals (1830)

- Dams (103)

- Dance (1023)

- Education (222)

- Floods (61)

- Folk music (1015)

- Forced removal, 1813-1903 (2)

- Forest conservation (220)

- Forests and forestry (1058)

- Gender nonconformity (4)

- Great Smoky Mountains National Park (N.C. and Tenn.) (181)

- Hunting (38)

- Landscape photography (10)

- Logging (103)

- Maps (84)

- Mines and mineral resources (8)

- North Carolina -- Maps (18)

- Paper industry (38)

- Postcards (255)

- Pottery (135)

- Railroad trains (71)

- Rural electrification -- North Carolina, Western (3)

- School integration -- Southern States (2)

- Segregation -- North Carolina, Western (5)

- Slavery (5)

- Sports (452)

- Storytelling (245)

- Waterfalls -- Great Smoky Mountains (N.C. and Tenn.) (66)

- Weaving -- Appalachian Region, Southern (280)

- Wood-carving -- Appalachian Region, Southern (328)

- World War, 1939-1945 (173)

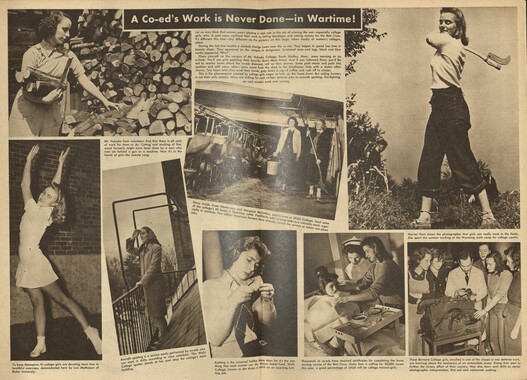

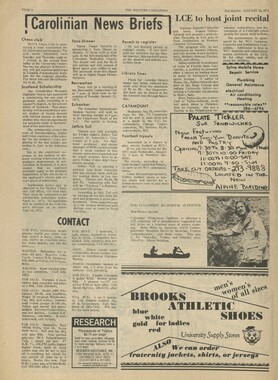

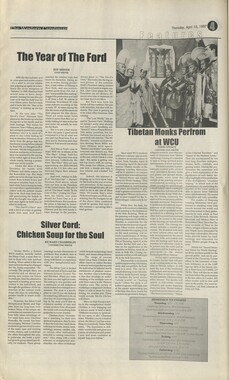

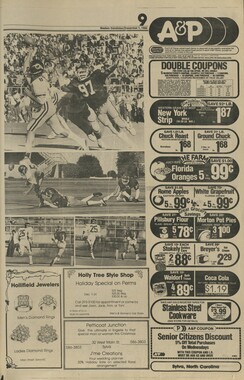

Western Carolinian Volume 46 Number 03

Item

Item’s are ‘child’ level descriptions to ‘parent’ objects, (e.g. one page of a whole book).

-

-

Grants Federal Aid Programs by Kyle Little Staff Writer Approximately six out of every ten students who are registered at WCU this fall are receiving some type of firiancial assistance, according to Glenn Hardesty, Director of Student Financial Aid. Over five million dollars in assistance will be received by Western students during the 1980-1981 fiscal year. This money comes from a number of different sources, the largest being through Federal aid programs. Federal money is distributed to students through a variety of programs, most of which require demonstrated financial need as reflected by the Financial Aid Form of the College Scholarship Service. The distribution of funds through these programs is by means of grants, loans, and work. Grants are gifts of monev which the recipient never has to repay, rhej arc awarded on the basis of need, rhe basic types of grants arc: 1. Basic Educational Opportunity Grant [BEOG|. A Basic Grant or BEOG award may range from $200 to $1,800 per year, depending on certain factors such as family income, attests, liabilities, number in family, and the cost of the school which the applicant plans to attend. All students who apply for any kind of financial aid. whether it be state of Federal, must also apply for BEOG. BEOG awards for 1980-1981 have been reduced $50 per recipient as part of the President's efforts to balance the budget. 2. Supplemental Educational Opportunity Grant [SEOG|.SEOG is for undergraduate students who could not continue their educations without it. Generally, these grants 'ranged from $200 to $1,500 per year, depending on the seriousness of the individual's need. 3. State Student Incentive Grant Program or North Carolina Student Incentive Grant [NCSIGJ. State Student Incentive Grant programs are administered by state agencies responsible for allocating monies made up of equal parts of state and Federal funds. This grant can be worth as much as $1,500 a year depending on the seriousness of thf» individual's need. 4.Law Enforcement Education Program [LEEP]. LEEP grants are available to students working in the field of law enforcement (police department or highway patrol), and cover tuition cost. Current regulations require that one must have been a recipient of a LEEP grant in the previous year in order to qualify. Another form of financial aid which does not have to be repaid is College Work Study [CWSP]. Although different from a grant in that it does not directly reduce tutition costs, th» college work study program is designed to assist needy students to earn part of their expenses by working part time as they attend school. Preference is given to students with the greatest financial need. In addition to grants and work study, the Federal Government also supplies a loan program as an alternative. These loan funds are given to and distributed by schools or the school may refer the student to a private lender, such as a bank or credit union. Unlike grants and college work study, loans must be repaid. Loan repayments begin 9 months after leaving school. The most common loans available arc: 1. National Direct Student Loan NDSL]. This is a low-interest (3 percent) loan made directly to students who demonstrate financial need. An annual allocation of funds is made to schools to use in meeting the financial needs of their students. Qualified students may borrow up to $5,000 for four years of school. 2. Guaranteed Student Loan [GSL]. GSL is a 7 percent interest loan available to any student regardless of financial need. A private lender, or in some case the school or a state agency, makes the loan. It is possible to obtain up to $2,500 per year, or $7,500 for 4 years, under the GSL program. While the student is in school, the Federal Government pays the interest on the loan; however, the student begins repayment of the loan nine months after leaving school. 3. Another state program is the North Carolina Insured Student Loan [NCISLj. To be eligible, you must be a legal resident of North Carolina, accepted for enrollment or enrolled in a college or vocational school in or out of state. The maximum amount obtainable for undergraduates is $2,500 per year so long as this amount does not exceed one-half the total educational expense for the year. The maximum amount for graduates is the total cost of education or $5,000, whichever is less. The loan also cannot exceed the Continues on Page 9.. TiWSYM CHURCHOFmist WELCOMES Wist/ SttnJ*. 7* Pokon, Cdfefcn Ml 1*0 on hit m* in fas WedfnJft P/tl T.0t> fOS H/eel thorn information7. M 21)-lH0 630 Blue Ribbon Shoe Store 2W. Main Street Sylva Featuring Acme Western Boots Men's and Women's At Discount Prices All Types of Hiking Shoes Also Ladies Shoes Expert Shoe Repair 586-2457 WE WELL ttEMSE SANDWICH EMPORIUM HOT DELI SANDWICHES Made with only the finest ingredients Riverwood Shops-Dillsboro 11 am-8pm MON-SAT 586-8588 September 4, 1980/Western Carolinian/ 5

Object

Object’s are ‘parent’ level descriptions to ‘children’ items, (e.g. a book with pages).

-

The Western Carolinian is Western Carolina University's student-run newspaper. The paper was published as the Cullowhee Yodel from 1924 to 1931 before changing its name to The Western Carolinian in 1933.

-