Western Carolina University (20)

View all

- Canton Champion Fibre Company (2308)

- Cherokee Traditions (291)

- Civil War in Southern Appalachia (165)

- Craft Revival (1942)

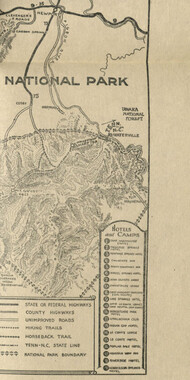

- Great Smoky Mountains - A Park for America (2946)

- Highlights from Western Carolina University (430)

- Horace Kephart (941)

- Journeys Through Jackson (159)

- LGBTQIA+ Archive of Jackson County (85)

- Oral Histories of Western North Carolina (314)

- Picturing Appalachia (6873)

- Stories of Mountain Folk (413)

- Travel Western North Carolina (160)

- Western Carolina University Fine Art Museum Vitreograph Collection (129)

- Western Carolina University Herbarium (92)

- Western Carolina University: Making Memories (738)

- Western Carolina University Publications (2491)

- Western Carolina University Restricted Electronic Theses and Dissertations (146)

- Western North Carolina Regional Maps (71)

- World War II in Southern Appalachia (131)

University of North Carolina Asheville (6)

View all

- Allanstand Cottage Industries (62)

- Appalachian National Park Association (53)

- Bennett, Kelly, 1890-1974 (1463)

- Berry, Walter (76)

- Brasstown Carvers (40)

- Carver, George Washington, 1864?-1943 (26)

- Cathey, Joseph, 1803-1874 (1)

- Champion Fibre Company (233)

- Champion Paper and Fibre Company (297)

- Cherokee Indian Fair Association (16)

- Cherokee Language Program (22)

- Crowe, Amanda (40)

- Edmonston, Thomas Benton, 1842-1907 (7)

- Ensley, A. L. (Abraham Lincoln), 1865-1948 (275)

- Fromer, Irving Rhodes, 1913-1994 (70)

- George Butz (BFS 1907) (46)

- Goodrich, Frances Louisa (120)

- Grant, George Alexander, 1891-1964 (96)

- Heard, Marian Gladys (60)

- Kephart, Calvin, 1883-1969 (15)

- Kephart, Horace, 1862-1931 (313)

- Kephart, Laura, 1862-1954 (39)

- Laney, Gideon Thomas, 1889-1976 (439)

- Masa, George, 1881-1933 (61)

- McElhinney, William Julian, 1896-1953 (44)

- Niggli, Josephina, 1910-1983 (10)

- North Carolina Park Commission (105)

- Osborne, Kezia Stradley (9)

- Owens, Samuel Robert, 1918-1995 (11)

- Penland Weavers and Potters (36)

- Roberts, Vivienne (15)

- Roth, Albert, 1890-1974 (142)

- Schenck, Carl Alwin, 1868-1955 (1)

- Sherrill's Photography Studio (2565)

- Southern Highland Handicraft Guild (127)

- Southern Highlanders, Inc. (71)

- Stalcup, Jesse Bryson (46)

- Stearns, I. K. (213)

- Thompson, James Edward, 1880-1976 (226)

- United States. Indian Arts and Crafts Board (130)

- USFS (683)

- Vance, Zebulon Baird, 1830-1894 (1)

- Weaver, Zebulon, 1872-1948 (58)

- Western Carolina College (230)

- Western Carolina Teachers College (282)

- Western Carolina University (2008)

- Western Carolina University. Mountain Heritage Center (18)

- Whitman, Walt, 1819-1892 (10)

- Wilburn, Hiram Coleman, 1880-1967 (73)

- Williams, Isadora (3)

- Cain, Doreyl Ammons (0)

- Crittenden, Lorraine (0)

- Rhodes, Judy (0)

- Smith, Edward Clark (0)

- Appalachian Region, Southern (2569)

- Asheville (N.C.) (1923)

- Avery County (N.C.) (26)

- Blount County (Tenn.) (195)

- Buncombe County (N.C.) (1672)

- Cherokee County (N.C.) (283)

- Clay County (N.C.) (555)

- Graham County (N.C.) (236)

- Great Smoky Mountains National Park (N.C. and Tenn.) (519)

- Haywood County (N.C.) (3569)

- Henderson County (N.C.) (70)

- Jackson County (N.C.) (4912)

- Knox County (Tenn.) (35)

- Knoxville (Tenn.) (13)

- Lake Santeetlah (N.C.) (10)

- Macon County (N.C.) (420)

- Madison County (N.C.) (215)

- McDowell County (N.C.) (39)

- Mitchell County (N.C.) (132)

- Polk County (N.C.) (35)

- Qualla Boundary (982)

- Rutherford County (N.C.) (76)

- Swain County (N.C.) (2182)

- Transylvania County (N.C.) (270)

- Watauga County (N.C.) (12)

- Waynesville (N.C.) (86)

- Yancey County (N.C.) (72)

- Aerial Photographs (3)

- Aerial Views (60)

- Albums (books) (4)

- Articles (1)

- Artifacts (object Genre) (228)

- Bibliographies (1)

- Biography (general Genre) (2)

- Cards (information Artifacts) (38)

- Clippings (information Artifacts) (191)

- Copybooks (instructional Materials) (3)

- Crafts (art Genres) (622)

- Depictions (visual Works) (21)

- Design Drawings (1)

- Drawings (visual Works) (185)

- Envelopes (73)

- Exhibitions (events) (1)

- Facsimiles (reproductions) (1)

- Fiction (general Genre) (4)

- Financial Records (12)

- Fliers (printed Matter) (67)

- Glass Plate Negatives (381)

- Guidebooks (2)

- Internegatives (10)

- Interviews (815)

- Land Surveys (102)

- Letters (correspondence) (1013)

- Manuscripts (documents) (618)

- Maps (documents) (177)

- Memorandums (25)

- Minutes (administrative Records) (59)

- Negatives (photographs) (6090)

- Newsletters (1290)

- Newspapers (2)

- Notebooks (8)

- Occupation Currency (1)

- Paintings (visual Works) (1)

- Pen And Ink Drawings (1)

- Periodicals (193)

- Personal Narratives (10)

- Photographs (12976)

- Plans (maps) (1)

- Poetry (5)

- Portraits (4568)

- Postcards (329)

- Programs (documents) (181)

- Publications (documents) (2443)

- Questionnaires (65)

- Relief Prints (26)

- Sayings (literary Genre) (1)

- Scrapbooks (282)

- Sheet Music (2)

- Slides (photographs) (402)

- Songs (musical Compositions) (2)

- Sound Recordings (796)

- Specimens (92)

- Speeches (documents) (18)

- Tintypes (photographs) (8)

- Transcripts (322)

- Video Recordings (physical Artifacts) (23)

- Text Messages (0)

- A.L. Ensley Collection (275)

- Appalachian Industrial School Records (7)

- Appalachian National Park Association Records (336)

- Axley-Meroney Collection (2)

- Bayard Wootten Photograph Collection (20)

- Bethel Rural Community Organization Collection (7)

- Blumer Collection (5)

- C.W. Slagle Collection (20)

- Canton Area Historical Museum (2110)

- Carlos C. Campbell Collection (462)

- Cataloochee History Project (64)

- Cherokee Studies Collection (4)

- Daisy Dame Photograph Album (5)

- Daniel Boone VI Collection (1)

- Doris Ulmann Photograph Collection (112)

- Elizabeth H. Lasley Collection (1)

- Elizabeth Woolworth Szold Fleharty Collection (4)

- Frank Fry Collection (95)

- George Masa Collection (173)

- Gideon Laney Collection (452)

- Hazel Scarborough Collection (2)

- Hiram C. Wilburn Papers (28)

- Historic Photographs Collection (236)

- Horace Kephart Collection (861)

- Humbard Collection (33)

- Hunter and Weaver Families Collection (1)

- I. D. Blumenthal Collection (4)

- Isadora Williams Collection (4)

- Jesse Bryson Stalcup Collection (47)

- Jim Thompson Collection (224)

- John B. Battle Collection (7)

- John C. Campbell Folk School Records (80)

- John Parris Collection (6)

- Judaculla Rock project (2)

- Kelly Bennett Collection (1482)

- Love Family Papers (11)

- Major Wiley Parris Civil War Letters (3)

- Map Collection (12)

- McFee-Misemer Civil War Letters (34)

- Mountain Heritage Center Collection (4)

- Norburn - Robertson - Thomson Families Collection (44)

- Pauline Hood Collection (7)

- Pre-Guild Collection (2)

- Qualla Arts and Crafts Mutual Collection (12)

- R.A. Romanes Collection (681)

- Rosser H. Taylor Collection (1)

- Samuel Robert Owens Collection (94)

- Sara Madison Collection (144)

- Sherrill Studio Photo Collection (2558)

- Smoky Mountains Hiking Club Collection (616)

- Stories of Mountain Folk - Radio Programs (374)

- The Reporter, Western Carolina University (510)

- Venoy and Elizabeth Reed Collection (16)

- WCU Gender and Sexuality Oral History Project (32)

- WCU Mountain Heritage Center Oral Histories (25)

- WCU Oral History Collection - Mountain People, Mountain Lives (71)

- WCU Students Newspapers Collection (1923)

- Western North Carolina Tomorrow Black Oral History Project (69)

- William Williams Stringfield Collection (2)

- Zebulon Weaver Collection (109)

- African Americans (390)

- Appalachian Trail (35)

- Artisans (521)

- Cherokee art (84)

- Cherokee artists -- North Carolina (10)

- Cherokee language (21)

- Cherokee pottery (101)

- Cherokee women (208)

- Church buildings (189)

- Civilian Conservation Corps (U.S.) (111)

- College student newspapers and periodicals (2012)

- Dams (107)

- Dance (1023)

- Education (222)

- Floods (61)

- Folk music (1015)

- Forced removal, 1813-1903 (2)

- Forest conservation (220)

- Forests and forestry (1184)

- Gender nonconformity (4)

- Great Smoky Mountains National Park (N.C. and Tenn.) (181)

- Hunting (45)

- Landscape photography (25)

- Logging (119)

- Maps (83)

- Mines and mineral resources (8)

- North Carolina -- Maps (18)

- Paper industry (38)

- Postcards (255)

- Pottery (135)

- Railroad trains (72)

- Rural electrification -- North Carolina, Western (3)

- School integration -- Southern States (2)

- Segregation -- North Carolina, Western (5)

- Slavery (5)

- Sports (452)

- Storytelling (243)

- Waterfalls -- Great Smoky Mountains (N.C. and Tenn.) (66)

- Weaving -- Appalachian Region, Southern (280)

- Wood-carving -- Appalachian Region, Southern (328)

- World War, 1939-1945 (173)

Western Carolinian Volume 62 (63) Number 18

Item

Item’s are ‘child’ level descriptions to ‘parent’ objects, (e.g. one page of a whole book).

-

-

mews January 21, 1998 western ■• • arohnian 'Steps Ahead' Part 2 This is the second in a series of articles dealing with the university's big steps into the future. We begin with WCU's plans involving behavior and community expectations. "We call ourselves a 'community of scholarship,'" the chancellor said in the December update. "Our mission statement speaks to core values of responsibility, commitment, and integrity as the binding forces for our community. As we continue to develop this university, we need to be sure that we are appropriately acquainting students with the meaning of these core values." "Alcohol and drug abuse [are two areas] where our stand needs to be very clear, and the university is taking a number of important steps," said Bardo. One of these steps emphasizes an "alcohol free" freshman hall. Bardo explained that "this means that possession of alcohol (even in a closed container) in that residence hall is a serious violation of the Code of Student conduct." But wasn't it before? Bardo responded, "Underage drinking is, and always has been, a serious issue. Having alcohol in an alcohol-free residence hall is an additional offense—even if a person is of legal drinking age." Another issue of behavior and community expectations deals with the Greek community. In the December update, Bardo says that "students, faculty, and staff have been working diligently on a new relationship agreement with our fraternities and sororities. We are working to assure that any organization affiliated with the university is an asset and that the organization is true to its own organizing principles and character. Most leaders in the Intrafraternity Council and Panhellenic Council worked very hard on this agreement. There are a few organizations that have not yet 'bought in.'" Though he does not wish to disclose the identities of campus organization that have yet to agree with the work of the councils and the university, the chancellor states, "Organizations that do not comply with the new relationship face serious consequences." Two other areas that Western will be moving toward this semester deal with the new Freshmen Transition Program and further expansion of the University Center. Under the leadership of Frank Prochaska, who also heads CATS, the chancellor's decision-making body concerning the computer requirement, WCU will be taking a close look Photo by Seth Sams, into working with freshmen and others who have yet to declare a major. Retention of quality students is a key factor in this aspect of moving ahead. Plans for the newly renovated Hinds University Center (UC) include two more phases of expansion. Phase two will "most likely involve expanded student meeting spaces, office spaces, a multi-cultural center, and some commercial facilities," says Bardo. "We are considering restructuring some food service facilities to have an expanded, mall- type food court. We are also considering having spaces available for retail outlets in the form of a mini-mall. For example, there could be a campus movie theater, coffeehouse, Greek/Catamount clothing store and the like," he continued. Phase 2 of the UC restructuring will be based on a design from the University of Central Florida, which also has adopted a mini-mall type of UC. Phase 3 of the UC would involve an expansion of the current fitness center, an outdoor recreational pool with winter cover, and support facilities. Bardo says that he would like to see the UC, fitness center, and bookstore tied together into "a core of services for students." "If we can work it out, students may be able to access these services without having to go from building to building outside," says Bardo. Whereas Western will be moving ahead in areas such as documentation of the computer requirement, senior assessment, and behavioral issues, the UC will not end its restructuring until around 2001. The last issue of the chancellor's December update thanked everyone for their hard work over the past year. Because of the faculty, staff, and student body, the chancellor can already tell that "West- em [is] moving to a new level of excellence." Nominees Sought for Service Awards by James Carter WCU will be accepting nominations for the Paul A. Reid Distinguished Service Awards at Western Carolina University through Friday, February 13. Regardless of the unlucky application deadline, the two lucky and deserving recipients of the awards will receive $ 1,000 each. One cash award goes to a member of the faculty; the other will be earned by a member of the administrative staff. Both conferees will have shown excellent service throughout the academic year and throughout the last several years. Anyone who is a member of the university faculty, administration, staff, student body or board of trustees or a Western alumni may make nominations for the award. Nominees will be evaluated on "the extent and quality of service that contributes to the general welfare of WCU and enhances its reputation as a regional institution of higher education," said Brian Railsback, who chairs the awards selection committee. Other committee members are John Beegle, Mary Boat, Terry Kinnear, Paul Klaczynski, Marcia Girton, and board of trustees members Thomas Apodaca, Louis Bissette and Phillip Walker. These honors, among the most prestigious at WCU, will be presented at WCU's spring General Faculty Meeting and Awards Convocation. Anyone seeking more information about the Paul A. Reid Distinguished Service Awards can contact Brian Railsback in G-55 of Stillwell Building, by phone at (704) 227-7383, or by e- mail at brailsba@wpoff.wcu.edu. around the state The IRS Must Be Abolished by Senator Lauch Faircloth Synopsis: Senator Faircloth has now introduced a bill to create an IRS oversight board and abolish the tax code and the IRS in favor of a taxpayer-friendly system. I held a hearing recently in Raleigh on IRS abuses. I wanted to get outside the Washington, D.C., beltway and away from the special interests to hear from real North Carolinians about their problems with the IRS and the tax code. I expected to hear some disturbing news, but what I heard was truly shocking. From Doug and Nancy, I heard the story of a family trying to pay off their tax bill, and going so far as to put their house up for sale to pay off their debts in full. They thought that was the responsible thing to do. They made the mistake of telling the IRS of their good intentions. Their lives became a nightmare when the IRS placed a tax lien on their house, ruining their credit to this day. They still can't get the IRS to straighten things out with the credit bureaus—after all, they were volunteering to sell their house— but the IRS action branded them a bad credit risk and cost them thousands of extra dollars in interest on their car payments and other bills. From Mary, I heard the story of a day care operator who waited two years before an IRS agent responded to her requests for help. Of course, the penalties and interest kept accumulating. She has been working 17 to 18 hours a day to faithfully pay her $800 a month to the IRS, and has stubbornly refused to declare bankruptcy despite being told to do so several times by IRS agents. Two brothers, Bill and Bob Dobo, have actually been trying to give away $20 million to charities like the North Carolina Zoo, UNC Memorial Hospital and the University of North Carolina at Wilmington. All they need is an answer—either a yes or a no— from the IRS that the transaction will not impose a massive tax bill. For three years, they have heard nothing, and the charities continue to wait. From one witness after another I heard such stories—the IRS has become an impenetrable bureaucracy that can't give simple answers, but tramples all over people's rights, ruins their credit, and hounds them with tax liens and threatening notices in their effort to collect $1.5 trillion in taxes from the American people. It doesn't help that the tax laws being enforced by the IRS are over 17,000 pages long—seven times longer than the Bible— and growing. In fact, I brought such a stack of papers to my IRS hearing. Put together it was seven feet high! No one but a few tax attorneys and accountants who make their living off such complexity could possibly hope to understand our tax code. Small businesses, in particular, are being crushed by all the paperwork. Perri Morgan, the N.C. Director of the National Federation of Independent Business, testified that small corporations are paying a minimum of $724 in compliance costs for every $100 paid in income taxes. That's a total of $28.6 billion in compliance costs paid by these small business owners compared to $3.9 billion paid in income taxes. Amazingly, that is almost exactly how much money (roughly $4 billion) that the IRS now admits they wasted trying to develop a new computer system that turned out to be a total failure. To paraphrase Will Rogers, our tax code has made dishonest people out of honest people. That is one reason why I have introduced legislation to create a citizens oversight board of the IRS. My bill, the "IRS Oversight, Restructuring & Tax Code Elimination Act" (S.1555), creates an IRS oversight board composed entirely of private citizens who will review auditing and collections procedures of the IRS, force the IRS to provide more assistance to taxpayers, and make sure the IRS doesn't waste another $4 billion on failed computer systems. Besides setting up such a watchdog for the IRS, my bill terminates the existing tax code by December 31, 2000, and terminates the Internal Revenue Service by September 30, 2000. I think Congress needs such a deadline to force us to take bold action. Over the last 40 years, Congress created this monster, and we must pass the kinds of reforms that will get rid of it. Forcing ourselves to act is the only way to get this done. If you are having problems with the IRS, I want to hear from you. You can write me at: Senator Lauch Faircloth, 310 New Bern Avenue, Suite 120, Raleigh, NC 27601, or call me at (919) 856- 4791. You can also learn more about my plans to reform the IRS, or send me your IRS concerns at my new Internet address: http://www.senate.gov/ -faircloth/irs/ ^XenTntVuZsT ^ "** ^ Pr°Sident of th° N^na, Federation of

Object

Object’s are ‘parent’ level descriptions to ‘children’ items, (e.g. a book with pages).

-

The Western Carolinian is Western Carolina University's student-run newspaper. The paper was published as the Cullowhee Yodel from 1924 to 1931 before changing its name to The Western Carolinian in 1933.

-