Western Carolina University (20)

View all

- Canton Champion Fibre Company (2308)

- Cherokee Traditions (291)

- Civil War in Southern Appalachia (165)

- Craft Revival (1942)

- Great Smoky Mountains - A Park for America (2946)

- Highlights from Western Carolina University (430)

- Horace Kephart (941)

- Journeys Through Jackson (159)

- LGBTQIA+ Archive of Jackson County (85)

- Oral Histories of Western North Carolina (314)

- Picturing Appalachia (6873)

- Stories of Mountain Folk (413)

- Travel Western North Carolina (160)

- Western Carolina University Fine Art Museum Vitreograph Collection (129)

- Western Carolina University Herbarium (92)

- Western Carolina University: Making Memories (738)

- Western Carolina University Publications (2491)

- Western Carolina University Restricted Electronic Theses and Dissertations (146)

- Western North Carolina Regional Maps (71)

- World War II in Southern Appalachia (131)

University of North Carolina Asheville (6)

View all

- Allanstand Cottage Industries (62)

- Appalachian National Park Association (53)

- Bennett, Kelly, 1890-1974 (1463)

- Berry, Walter (76)

- Brasstown Carvers (40)

- Carver, George Washington, 1864?-1943 (26)

- Cathey, Joseph, 1803-1874 (1)

- Champion Fibre Company (233)

- Champion Paper and Fibre Company (297)

- Cherokee Indian Fair Association (16)

- Cherokee Language Program (22)

- Crowe, Amanda (40)

- Edmonston, Thomas Benton, 1842-1907 (7)

- Ensley, A. L. (Abraham Lincoln), 1865-1948 (275)

- Fromer, Irving Rhodes, 1913-1994 (70)

- George Butz (BFS 1907) (46)

- Goodrich, Frances Louisa (120)

- Grant, George Alexander, 1891-1964 (96)

- Heard, Marian Gladys (60)

- Kephart, Calvin, 1883-1969 (15)

- Kephart, Horace, 1862-1931 (313)

- Kephart, Laura, 1862-1954 (39)

- Laney, Gideon Thomas, 1889-1976 (439)

- Masa, George, 1881-1933 (61)

- McElhinney, William Julian, 1896-1953 (44)

- Niggli, Josephina, 1910-1983 (10)

- North Carolina Park Commission (105)

- Osborne, Kezia Stradley (9)

- Owens, Samuel Robert, 1918-1995 (11)

- Penland Weavers and Potters (36)

- Roberts, Vivienne (15)

- Roth, Albert, 1890-1974 (142)

- Schenck, Carl Alwin, 1868-1955 (1)

- Sherrill's Photography Studio (2565)

- Southern Highland Handicraft Guild (127)

- Southern Highlanders, Inc. (71)

- Stalcup, Jesse Bryson (46)

- Stearns, I. K. (213)

- Thompson, James Edward, 1880-1976 (226)

- United States. Indian Arts and Crafts Board (130)

- USFS (683)

- Vance, Zebulon Baird, 1830-1894 (1)

- Weaver, Zebulon, 1872-1948 (58)

- Western Carolina College (230)

- Western Carolina Teachers College (282)

- Western Carolina University (2008)

- Western Carolina University. Mountain Heritage Center (18)

- Whitman, Walt, 1819-1892 (10)

- Wilburn, Hiram Coleman, 1880-1967 (73)

- Williams, Isadora (3)

- Cain, Doreyl Ammons (0)

- Crittenden, Lorraine (0)

- Rhodes, Judy (0)

- Smith, Edward Clark (0)

- Appalachian Region, Southern (2569)

- Asheville (N.C.) (1923)

- Avery County (N.C.) (26)

- Blount County (Tenn.) (195)

- Buncombe County (N.C.) (1672)

- Cherokee County (N.C.) (283)

- Clay County (N.C.) (555)

- Graham County (N.C.) (236)

- Great Smoky Mountains National Park (N.C. and Tenn.) (519)

- Haywood County (N.C.) (3569)

- Henderson County (N.C.) (70)

- Jackson County (N.C.) (4912)

- Knox County (Tenn.) (35)

- Knoxville (Tenn.) (13)

- Lake Santeetlah (N.C.) (10)

- Macon County (N.C.) (420)

- Madison County (N.C.) (215)

- McDowell County (N.C.) (39)

- Mitchell County (N.C.) (132)

- Polk County (N.C.) (35)

- Qualla Boundary (982)

- Rutherford County (N.C.) (76)

- Swain County (N.C.) (2182)

- Transylvania County (N.C.) (270)

- Watauga County (N.C.) (12)

- Waynesville (N.C.) (86)

- Yancey County (N.C.) (72)

- Aerial Photographs (3)

- Aerial Views (60)

- Albums (books) (4)

- Articles (1)

- Artifacts (object Genre) (228)

- Bibliographies (1)

- Biography (general Genre) (2)

- Cards (information Artifacts) (38)

- Clippings (information Artifacts) (191)

- Copybooks (instructional Materials) (3)

- Crafts (art Genres) (622)

- Depictions (visual Works) (21)

- Design Drawings (1)

- Drawings (visual Works) (185)

- Envelopes (73)

- Exhibitions (events) (1)

- Facsimiles (reproductions) (1)

- Fiction (general Genre) (4)

- Financial Records (12)

- Fliers (printed Matter) (67)

- Glass Plate Negatives (381)

- Guidebooks (2)

- Internegatives (10)

- Interviews (815)

- Land Surveys (102)

- Letters (correspondence) (1013)

- Manuscripts (documents) (618)

- Maps (documents) (177)

- Memorandums (25)

- Minutes (administrative Records) (59)

- Negatives (photographs) (6090)

- Newsletters (1290)

- Newspapers (2)

- Notebooks (8)

- Occupation Currency (1)

- Paintings (visual Works) (1)

- Pen And Ink Drawings (1)

- Periodicals (193)

- Personal Narratives (10)

- Photographs (12976)

- Plans (maps) (1)

- Poetry (5)

- Portraits (4568)

- Postcards (329)

- Programs (documents) (181)

- Publications (documents) (2443)

- Questionnaires (65)

- Relief Prints (26)

- Sayings (literary Genre) (1)

- Scrapbooks (282)

- Sheet Music (2)

- Slides (photographs) (402)

- Songs (musical Compositions) (2)

- Sound Recordings (796)

- Specimens (92)

- Speeches (documents) (18)

- Tintypes (photographs) (8)

- Transcripts (322)

- Video Recordings (physical Artifacts) (23)

- Text Messages (0)

- A.L. Ensley Collection (275)

- Appalachian Industrial School Records (7)

- Appalachian National Park Association Records (336)

- Axley-Meroney Collection (2)

- Bayard Wootten Photograph Collection (20)

- Bethel Rural Community Organization Collection (7)

- Blumer Collection (5)

- C.W. Slagle Collection (20)

- Canton Area Historical Museum (2110)

- Carlos C. Campbell Collection (462)

- Cataloochee History Project (64)

- Cherokee Studies Collection (4)

- Daisy Dame Photograph Album (5)

- Daniel Boone VI Collection (1)

- Doris Ulmann Photograph Collection (112)

- Elizabeth H. Lasley Collection (1)

- Elizabeth Woolworth Szold Fleharty Collection (4)

- Frank Fry Collection (95)

- George Masa Collection (173)

- Gideon Laney Collection (452)

- Hazel Scarborough Collection (2)

- Hiram C. Wilburn Papers (28)

- Historic Photographs Collection (236)

- Horace Kephart Collection (861)

- Humbard Collection (33)

- Hunter and Weaver Families Collection (1)

- I. D. Blumenthal Collection (4)

- Isadora Williams Collection (4)

- Jesse Bryson Stalcup Collection (47)

- Jim Thompson Collection (224)

- John B. Battle Collection (7)

- John C. Campbell Folk School Records (80)

- John Parris Collection (6)

- Judaculla Rock project (2)

- Kelly Bennett Collection (1482)

- Love Family Papers (11)

- Major Wiley Parris Civil War Letters (3)

- Map Collection (12)

- McFee-Misemer Civil War Letters (34)

- Mountain Heritage Center Collection (4)

- Norburn - Robertson - Thomson Families Collection (44)

- Pauline Hood Collection (7)

- Pre-Guild Collection (2)

- Qualla Arts and Crafts Mutual Collection (12)

- R.A. Romanes Collection (681)

- Rosser H. Taylor Collection (1)

- Samuel Robert Owens Collection (94)

- Sara Madison Collection (144)

- Sherrill Studio Photo Collection (2558)

- Smoky Mountains Hiking Club Collection (616)

- Stories of Mountain Folk - Radio Programs (374)

- The Reporter, Western Carolina University (510)

- Venoy and Elizabeth Reed Collection (16)

- WCU Gender and Sexuality Oral History Project (32)

- WCU Mountain Heritage Center Oral Histories (25)

- WCU Oral History Collection - Mountain People, Mountain Lives (71)

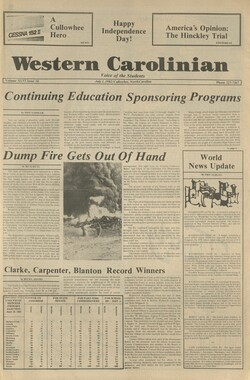

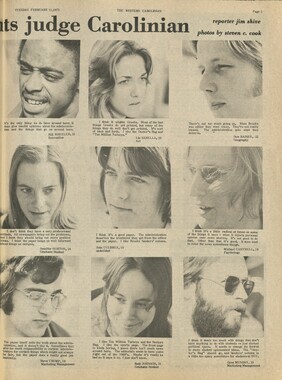

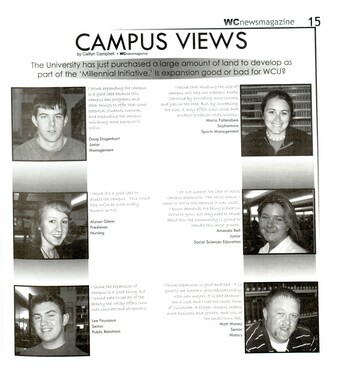

- WCU Students Newspapers Collection (1923)

- Western North Carolina Tomorrow Black Oral History Project (69)

- William Williams Stringfield Collection (2)

- Zebulon Weaver Collection (109)

- African Americans (390)

- Appalachian Trail (35)

- Artisans (521)

- Cherokee art (84)

- Cherokee artists -- North Carolina (10)

- Cherokee language (21)

- Cherokee pottery (101)

- Cherokee women (208)

- Church buildings (189)

- Civilian Conservation Corps (U.S.) (111)

- College student newspapers and periodicals (2012)

- Dams (107)

- Dance (1023)

- Education (222)

- Floods (61)

- Folk music (1015)

- Forced removal, 1813-1903 (2)

- Forest conservation (220)

- Forests and forestry (1184)

- Gender nonconformity (4)

- Great Smoky Mountains National Park (N.C. and Tenn.) (181)

- Hunting (45)

- Landscape photography (25)

- Logging (119)

- Maps (83)

- Mines and mineral resources (8)

- North Carolina -- Maps (18)

- Paper industry (38)

- Postcards (255)

- Pottery (135)

- Railroad trains (72)

- Rural electrification -- North Carolina, Western (3)

- School integration -- Southern States (2)

- Segregation -- North Carolina, Western (5)

- Slavery (5)

- Sports (452)

- Storytelling (243)

- Waterfalls -- Great Smoky Mountains (N.C. and Tenn.) (66)

- Weaving -- Appalachian Region, Southern (280)

- Wood-carving -- Appalachian Region, Southern (328)

- World War, 1939-1945 (173)

Western Carolinian Volume 68 Number 06

Item

Item’s are ‘child’ level descriptions to ‘parent’ objects, (e.g. one page of a whole book).

-

-

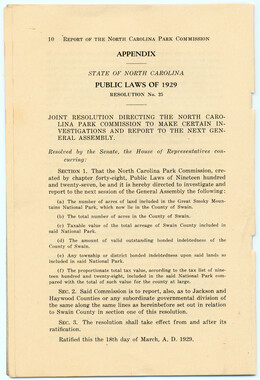

Economy Outlook Brightens, Fed Reports By Bill Atkinson | The Baltimore Sun The economic recovery picked up steam heading into fall with even the beleaguered manufacturing sector showing signs of strength, the Federal Reserve reported Wednesday. Ten of the central banks 12 districts reported that activity has been expanding, while Boston and Cleveland turned in mixed but steady levels of economic activity, according to the Feds Beige Book, a snapshot of economic conditions issued every six weeks. Hurricane Isabel inflicted limited damage in the states in the Feds Richmond District, which includes Maryland, Virginia, West Virginia, the Carolinas and the District of Columbia. Hardware stores, restaurants and grocery stores in the district recorded brisk sales in the storms aftermath. The latest report, which looked at conditions from late August through Oct. 6, is pretty bullish and optimistic, said Sung Won Sohn, chief economist at Minneapolis-based Wells Fargo & Co. It looks like pretty much every sector of the economy is going forward in the right direction. Michael Englund, chief economist at MMS International, an international financial consulting firm in New York, said the Fed appears to be realizing that the economy is healing. They remain among the hardest to convince, Englund said. We are seeing that they are giving up some ground and willing to concede a stronger economic outlook. But some economists cautioned that a chief ingredient of recovery job growth remained elusive. Having picked up from the last report might not mean we have shaken the sluggishness that has characterized the past couple of years, said Carl R. Tannenbaum, chief economist at LaSalle/ABN AMRO Bank in Chicago. Few companies are hiring workers and expanding their businesses. The report called the labor markets slack, though there are modest signs of improvement in a number of districts. People without jobs typically dont spend a lot of money, Tannenbaum said. The lack of hiring, he said, leaves open the question: is that (rebound) artificial or is that real? Even with the lack of hiring, consumers the main engine driving the economy continued to open their wallets, although car sales weakened. Several districts said the Bush administrations tax rebates helped boost sales, and retailers said they were optimistic that this holiday season would be better than 2002. Last year we were dealing with the threat of war. The year before that, we had concerns after 9/11. This potentially could be one of the years where we may not have a lot of the disturbing events, and sales could be pretty good, said Gary Thayer, chief economist at A.G. Edwards & Sons Inc. in St. Louis. Manufacturing, which has seen 2.6 million jobs evaporate over the past three years, showed some gains. The Atlanta and Chicago districts reported strong orders for machine tools, a sign that manufacturers planned increased production, while semiconductor producers on the West Coast experienced increased demand. Manufacturing employment exhibited modest gains in some districts, but in most was stable or declining, according to the report. Residential real estate, which has sizzled, continues to be robust, most districts reported. A few districts specify that the recent increase in mortgage rates appears to have had at most a limited impact on home sales, according to the report. Some builders have had trouble getting plywood, which has risen in price in a number of districts along with lumber. The Fed also reported sharp price increases in cattle and steel, among other commodities. Thayer said rising commodity prices were a sign that the United States and other countries were starting to grow. It looks like world demand is picking, he said. I think that is a pretty significant change. Tourism and travel also improved, the report said. New York and San Francisco reported an increase in international visitors, while Boston, Minneapolis and Kansas City noted some gains in business travel. Despite the economys pickup, economists said they didnt expect the Fed to raise interest rates at its meeting Oct. 28. I think we are still talking about quite a few months before the Fed _ contemplates hiking interest rates, Sohn. said. 2003 Distributed by the Los Angeles Times- ee a Washington Post News Service Suburban Poverty Grows U.S. Poverty Rate Up for Second Straight Year By Jonathan Weisman | The Washington Post Nearly 1.7 million people fell into poverty last year, ticking the official poverty rate up to 12.1 percent from the 2001 rate of 11.7 percent, the second straight year that poverty has increased in the United States, the U.S. Census Bureau reported Friday. The annual report, which also showed a decline in median household income, comes at a politically charged time, when President Bushs approval ratings have hit the lowest levels of his term and Democratic presidential candidates have focused their criticism of Bush on his economic stewardship. Moreover, the poverty increases were particularly concentrated last year in politically sensitive populations: African Americans, suburban residents and Midwesterners. Poverty levels rose precisely in many of the states that are likely to determine the next president: Arkansas, Florida, Illinois and Michigan, as well as Hawaii, Maine, Mississippi, South Carolina and Utah. Overall, the Census Bureau figures paint a picture of the worst-off Americans struggling to recover from the 2001 recession. Daniel Weinberg, chief of the bureaus housing and household economic statistics division, says the decline in income and rise in poverty perfectly mirror statistics from virtually all previous recessions. He suggested the numbers may have been worse had it not been for Bushs $1.35 trillion tax cut passed in 2001 and a rise in the value of food stamps and housing subsidies. The two bright spots in the survey were income disparity, which declined under the most sophisticated measurements, and the gap between the earnings of women and men, which reached its narrowest level ever. Women earn 77 cents to a mans dollar. Nationally, median household money income fell 1.1 percentby $500between 2001 and 2002, to $42,409 from $42,900. After-tax income fell a slightly smaller 0.8 percent. Since cash incomes peaked in 1999 at $43,915, household money income has dropped $1,506. The poverty rate has risen from a trough of 11.3 percent in 2000 to the 2002 rate of 12.1 percent. In 2001 and 2002, 3 million Americans slipped beneath the official poverty line, which, for an individual under 65 is $9,359 a year and for a family of four is $18,244. By the end of last year, 34.6 million Americans lived in poverty. Among those, 12.1 million are children, up from 11.7 million in 2001. Since 2002, the U.S. economy has shown clearer signs of recovery. The Commerce Department on Friday revised growth in the second quarter of this year up for a second time, to a strong 3.3 percent. And most economists foresee far stronger growth in the last half of this year. But that stronger growth has yet to be reflected in the job market, where employment has continued to fall. And employment is the key factor in poverty rates, economists say. In all, 1.2 million more suburbanites were living in poverty than in 2001, a total of 13.3 million. The poverty changes in 2002 were particularly concentrated. Poverty rates were unchanged for self-identified whites, Latinos and Asians, but African Americans saw an increase in the poverty rate from 23.9 percent to 24.1 percent. Regionally, poverty rates in the Northeast, South and West did not change last year, but they inched up in the Midwest, to 10.3 percent, from 9.4 percent. Likewise, inner city and rural households saw no change in the level of official poverty, but suburban residents experienced an increase in official poverty to 8.9 percent, from 8.2 percent. In all, 1.2 million more suburbanites were living in poverty than in 2001, a total of 13.3 million. The Census Bureau figures show the difficulty the president faces in taking power following the economic heights of the 1990s boom. At 12.1 percent, the 2002 poverty rate is actually lower than the 12.7 percent rate in 1998. Excluding 1999 through 2001, last years poverty level was lower than every year since 1979, since modern records began in 1959. Only 10 years in the past 43 has the poverty rate been lower than the 2002 level. 2003 WASHINGTON POST * * pea Id 8 8 Oh A, i Se A 5 Fy 2 ced De Mea A

Object

Object’s are ‘parent’ level descriptions to ‘children’ items, (e.g. a book with pages).

-

The Western Carolinian is Western Carolina University's student-run newspaper. The paper was published as the Cullowhee Yodel from 1924 to 1931 before changing its name to The Western Carolinian in 1933.

-