Western Carolina University (21)

View all

- Canton Champion Fibre Company (2308)

- Cherokee Traditions (291)

- Civil War in Southern Appalachia (165)

- Craft Revival (1942)

- George Masa Collection (137)

- Great Smoky Mountains - A Park for America (3080)

- Highlights from Western Carolina University (422)

- Horace Kephart (998)

- Journeys Through Jackson (159)

- LGBTQIA+ Archive of Jackson County (90)

- Oral Histories of Western North Carolina (318)

- Picturing Appalachia (6617)

- Stories of Mountain Folk (413)

- Travel Western North Carolina (153)

- Western Carolina University Fine Art Museum Vitreograph Collection (129)

- Western Carolina University Herbarium (92)

- Western Carolina University: Making Memories (738)

- Western Carolina University Publications (2491)

- Western Carolina University Restricted Electronic Theses and Dissertations (146)

- Western North Carolina Regional Maps (71)

- World War II in Southern Appalachia (131)

University of North Carolina Asheville (6)

View all

- Allanstand Cottage Industries (62)

- Appalachian National Park Association (53)

- Bennett, Kelly, 1890-1974 (1463)

- Berry, Walter (76)

- Brasstown Carvers (40)

- Carver, George Washington, 1864?-1943 (26)

- Cathey, Joseph, 1803-1874 (1)

- Champion Fibre Company (233)

- Champion Paper and Fibre Company (297)

- Cherokee Indian Fair Association (16)

- Cherokee Language Program (22)

- Crowe, Amanda (40)

- Edmonston, Thomas Benton, 1842-1907 (7)

- Ensley, A. L. (Abraham Lincoln), 1865-1948 (275)

- Fromer, Irving Rhodes, 1913-1994 (70)

- George Butz (BFS 1907) (46)

- Goodrich, Frances Louisa (120)

- Grant, George Alexander, 1891-1964 (96)

- Heard, Marian Gladys (60)

- Kephart, Calvin, 1883-1969 (15)

- Kephart, Horace, 1862-1931 (313)

- Kephart, Laura, 1862-1954 (91)

- Laney, Gideon Thomas, 1889-1976 (439)

- Masa, George, 1881-1933 (61)

- McElhinney, William Julian, 1896-1953 (44)

- Niggli, Josephina, 1910-1983 (10)

- North Carolina Park Commission (105)

- Osborne, Kezia Stradley (9)

- Owens, Samuel Robert, 1918-1995 (11)

- Penland Weavers and Potters (36)

- Roberts, Vivienne (15)

- Roth, Albert, 1890-1974 (142)

- Schenck, Carl Alwin, 1868-1955 (1)

- Sherrill's Photography Studio (2565)

- Southern Highland Handicraft Guild (127)

- Southern Highlanders, Inc. (71)

- Stalcup, Jesse Bryson (46)

- Stearns, I. K. (213)

- Thompson, James Edward, 1880-1976 (226)

- United States. Indian Arts and Crafts Board (130)

- USFS (683)

- Vance, Zebulon Baird, 1830-1894 (1)

- Weaver, Zebulon, 1872-1948 (58)

- Western Carolina College (230)

- Western Carolina Teachers College (282)

- Western Carolina University (2008)

- Western Carolina University. Mountain Heritage Center (18)

- Whitman, Walt, 1819-1892 (10)

- Wilburn, Hiram Coleman, 1880-1967 (73)

- Williams, Isadora (3)

- Cain, Doreyl Ammons (0)

- Crittenden, Lorraine (0)

- Rhodes, Judy (0)

- Smith, Edward Clark (0)

- Appalachian Region, Southern (3032)

- Asheville (N.C.) (1945)

- Avery County (N.C.) (26)

- Blount County (Tenn.) (195)

- Buncombe County (N.C.) (1680)

- Cherokee County (N.C.) (283)

- Clay County (N.C.) (556)

- Graham County (N.C.) (238)

- Great Smoky Mountains National Park (N.C. and Tenn.) (535)

- Haywood County (N.C.) (3573)

- Henderson County (N.C.) (70)

- Jackson County (N.C.) (4926)

- Knox County (Tenn.) (35)

- Knoxville (Tenn.) (13)

- Lake Santeetlah (N.C.) (10)

- Macon County (N.C.) (421)

- Madison County (N.C.) (216)

- McDowell County (N.C.) (39)

- Mitchell County (N.C.) (135)

- Polk County (N.C.) (35)

- Qualla Boundary (982)

- Rutherford County (N.C.) (78)

- Swain County (N.C.) (2185)

- Transylvania County (N.C.) (270)

- Watauga County (N.C.) (12)

- Waynesville (N.C.) (86)

- Yancey County (N.C.) (72)

- Aerial Photographs (3)

- Aerial Views (60)

- Albums (books) (4)

- Articles (1)

- Artifacts (object Genre) (228)

- Bibliographies (1)

- Biography (general Genre) (2)

- Cards (information Artifacts) (38)

- Clippings (information Artifacts) (193)

- Copybooks (instructional Materials) (3)

- Crafts (art Genres) (622)

- Depictions (visual Works) (21)

- Design Drawings (1)

- Digital Moving Image Formats (2)

- Drawings (visual Works) (185)

- Envelopes (115)

- Exhibitions (events) (1)

- Facsimiles (reproductions) (1)

- Fiction (general Genre) (4)

- Financial Records (12)

- Fliers (printed Matter) (67)

- Glass Plate Negatives (381)

- Guidebooks (2)

- Internegatives (10)

- Interviews (823)

- Land Surveys (102)

- Letters (correspondence) (1070)

- Manuscripts (documents) (618)

- Maps (documents) (177)

- Memorandums (25)

- Minutes (administrative Records) (59)

- Negatives (photographs) (6090)

- Newsletters (1290)

- Newspapers (2)

- Notebooks (8)

- Occupation Currency (1)

- Paintings (visual Works) (1)

- Pen And Ink Drawings (1)

- Periodicals (194)

- Personal Narratives (10)

- Photographs (12977)

- Plans (maps) (1)

- Poetry (6)

- Portraits (4568)

- Postcards (329)

- Programs (documents) (181)

- Publications (documents) (2444)

- Questionnaires (65)

- Relief Prints (26)

- Sayings (literary Genre) (1)

- Scrapbooks (282)

- Sheet Music (2)

- Slides (photographs) (402)

- Songs (musical Compositions) (2)

- Sound Recordings (802)

- Specimens (92)

- Speeches (documents) (18)

- Tintypes (photographs) (8)

- Transcripts (329)

- Text Messages (0)

- A.L. Ensley Collection (275)

- Appalachian Industrial School Records (7)

- Appalachian National Park Association Records (336)

- Axley-Meroney Collection (2)

- Bayard Wootten Photograph Collection (20)

- Bethel Rural Community Organization Collection (7)

- Blumer Collection (5)

- C.W. Slagle Collection (20)

- Canton Area Historical Museum (2110)

- Carlos C. Campbell Collection (462)

- Cataloochee History Project (64)

- Cherokee Studies Collection (4)

- Daisy Dame Photograph Album (5)

- Daniel Boone VI Collection (1)

- Doris Ulmann Photograph Collection (112)

- Elizabeth H. Lasley Collection (1)

- Elizabeth Woolworth Szold Fleharty Collection (4)

- Frank Fry Collection (95)

- George Masa Collection (173)

- Gideon Laney Collection (452)

- Hazel Scarborough Collection (2)

- Hiram C. Wilburn Papers (28)

- Historic Photographs Collection (236)

- Horace Kephart Collection (861)

- Humbard Collection (33)

- Hunter and Weaver Families Collection (1)

- I. D. Blumenthal Collection (4)

- Isadora Williams Collection (4)

- Jesse Bryson Stalcup Collection (47)

- Jim Thompson Collection (224)

- John B. Battle Collection (7)

- John C. Campbell Folk School Records (80)

- John Parris Collection (6)

- Judaculla Rock project (2)

- Kelly Bennett Collection (1482)

- Love Family Papers (11)

- Major Wiley Parris Civil War Letters (3)

- Map Collection (12)

- McFee-Misemer Civil War Letters (34)

- Mountain Heritage Center Collection (4)

- Norburn - Robertson - Thomson Families Collection (44)

- Pauline Hood Collection (7)

- Pre-Guild Collection (2)

- Qualla Arts and Crafts Mutual Collection (12)

- R.A. Romanes Collection (681)

- Rosser H. Taylor Collection (1)

- Samuel Robert Owens Collection (94)

- Sara Madison Collection (144)

- Sherrill Studio Photo Collection (2558)

- Smoky Mountains Hiking Club Collection (616)

- Stories of Mountain Folk - Radio Programs (374)

- The Reporter, Western Carolina University (510)

- Venoy and Elizabeth Reed Collection (16)

- WCU Gender and Sexuality Oral History Project (36)

- WCU Mountain Heritage Center Oral Histories (25)

- WCU Oral History Collection - Mountain People, Mountain Lives (71)

- WCU Students Newspapers Collection (1923)

- Western North Carolina Tomorrow Black Oral History Project (69)

- William Williams Stringfield Collection (2)

- Zebulon Weaver Collection (109)

- African Americans (390)

- Appalachian Trail (35)

- Artisans (521)

- Cherokee art (84)

- Cherokee artists -- North Carolina (10)

- Cherokee language (21)

- Cherokee pottery (101)

- Cherokee women (208)

- Church buildings (190)

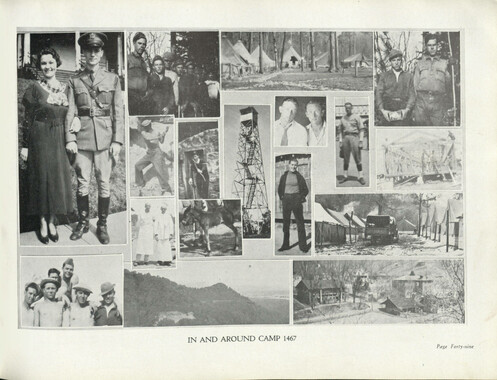

- Civilian Conservation Corps (U.S.) (111)

- College student newspapers and periodicals (2012)

- Dams (108)

- Dance (1023)

- Education (222)

- Floods (63)

- Folk music (1015)

- Forced removal, 1813-1903 (2)

- Forest conservation (220)

- Forests and forestry (1198)

- Gender nonconformity (4)

- Great Smoky Mountains National Park (N.C. and Tenn.) (181)

- Hunting (47)

- Landscape photography (25)

- Logging (122)

- Maps (83)

- Mines and mineral resources (9)

- North Carolina -- Maps (18)

- Paper industry (38)

- Postcards (255)

- Pottery (135)

- Railroad trains (72)

- Rural electrification -- North Carolina, Western (3)

- School integration -- Southern States (2)

- Segregation -- North Carolina, Western (5)

- Slavery (5)

- Sports (452)

- Storytelling (243)

- Waterfalls -- Great Smoky Mountains (N.C. and Tenn.) (66)

- Weaving -- Appalachian Region, Southern (280)

- Wood-carving -- Appalachian Region, Southern (328)

- World War, 1939-1945 (174)

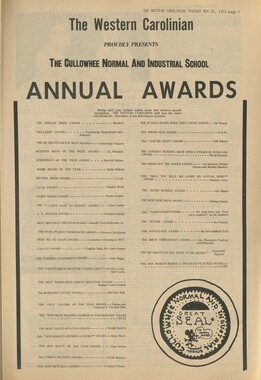

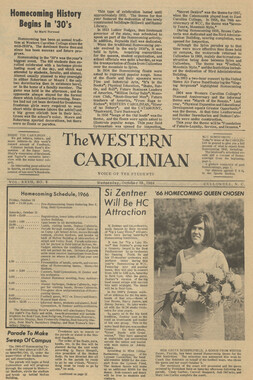

Western Carolinian Volume 64 (65) Number 22

Item

Item’s are ‘child’ level descriptions to ‘parent’ objects, (e.g. one page of a whole book).

-

-

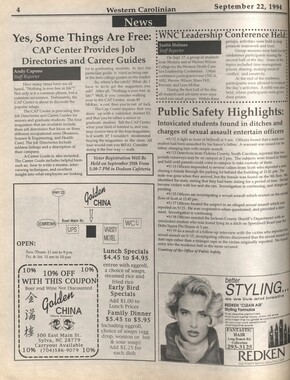

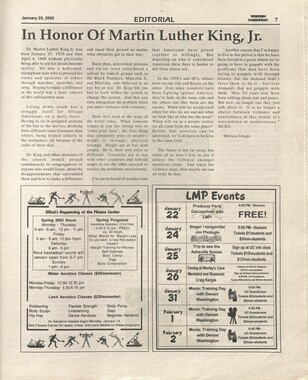

WESTERN 4 CAROLINIAN NEWS February 23, 2000 Student Volunteers Help with IRS Program by Craig Day Staff Writer The Volunteer Income Tax Assistance program, otherwise known as VITA, is a fast, inexpensive and convenient alternative to the completion of 1999 income tax forma not only for students and faculty of WCU, but also for Sylva and Cullowhee residents. The VITA program, sponsored by the IRS, is set up nationwide to provide free income lax tiling. "Although open to anyone, the VITA program is especially designed to benefit lower-income residents who might not be able to pay for professional accounting help." said Dr. Roger Lirely, assistant professor of accounting and information systems. Lirely is also the advisor of the WCU chapter of the Institute of Management Accountants that is providing the free income tax assistance. The income tax preparation is completed by student volunteers, who partici pated in a series of training sessions in January and have completed a certification test that consists of 75 pages. The volunteers will be using tax preparation software that handles tax forms 1040,1040-EZand 1040-A. "The students taking advantage of this service," Lirely said, "do not have to worry about gathering their information and taking it home and finding someone on the weekend to do this. We need their W2s, tuition statement for computation of education credits, such as the Hope and Life Time Learning credits and we also need any records they have relating to interest or dividend incomes and any other tax related materials they have received. It is also free of charge and most services charge anywhere from $50 to $100." Automatic deposit through the VITA program is available at no charge as well. Lirely stated, "If participants want their tax refunds automatically deposited, we need a deposit slip or a check for that account so that we can get the routing number and Koestner Returns to WCU by Crystal Frame Editor-in-Chief Returning to Cullowhee for a second year. Katie Koestner, a well-known vocal date-rape survivor, will lecture about sexual assault and violence against women and ways to prevent this campus-wide problem, at 6pm on Wednesday, March I, in the University Center Grandroom. Co-presented by Brett Sokolow, the "He Said—She Said" program will include several interactive scenarios on sexual assault, with the audience acting as a jury. Later, the audience will split into same-sex groups for facilitated workshops with Koestner and Sokolow. The duo has lectured to hundreds of thousands of students at over 600 colleges, high schools, and military institutions in 47 states over the last four years. Koestner received national recognition after appearing on the cover of Time magazine in 1991, and television shows such as the Oprah Winfrey Show and Good Morning America, after she went public with her story of being sexually assaulted by a fellow student at the College of William and Mary. Since she began her job as a date rape awareness educator, Koestner has kept a journal of all her visits to various photo courtesy campusoutreachservices.com Katie Koestner's goal is to "reach as many students with her messages as possible, while she is still young enough for them to be able to relate to her as a peer." the account number." H & R Block charges a basic fee of $40 for federal tax returns and $12 for state returns. There are additional charges for the difficulty of the tax return, for electronic filing and for automatic deposit into a checking account. In relation to international students or multi-state students, assistance is also available. "We get a number of students who are multi-sate," Lirely said, "but because of the complexity, because we are only provided with IRS and North Carolina preparation software, it is going to take us a little longer and we may not be able to get that person done in a day. It requires downloading forms from a web site and manually preparing tax forms for the other states. Since this is the case, international and multi-state students should call ahead to make an appointment for a consultation." Lirely also stated that, in terms of liability, there has only been one correction made to a return in the three years that this schools around the nation. She plans to write a book due out sometime this year using the journal to show the disturbing number of sexual assault victims found on many campuses. Sokolow is an attorney who specializes in sexual assault policy and law. He has served as an intern to the Victim's Advocacy Legal Organization (VALOR) and has established college peer counselor organizations to help sexual assault survivors. Founding Men Acting for Change at the College of William and Mary (similar to Western's Brother Peace organization), Sokolow strives to create awareness on women's issues. Hoping to reach as many students as possible, Koestner and Sokolow founded the Campus Outreach Services, Inc. (COS) in 1994. COS has been the only national consulting firm dedicated exclusively for higher education risk management issues. Some of the high-risk issues include sexual assault, sexual harassment, and campus safety. The COS consultants work with each institution's legal and administrative departments to form the overall goal of creating a much safer campus life. After Koestner's presentation, there will be a showing of "No Visible Bruises: The Katie Koestner Story" which originally appeared on HBO in program has been operating. "There is always the possibility that the IRS will question an item on a tax return," Lirely said. "Generally, the IRS will handle things, such as transposed numbers and incorrect arithmetic, by sending a correction. If we electronically transmit these tax returns via the Internet to Universal Tax Systems, the company that makes the software, they verify that the form is suitable for transmission to the IRS... If there is any incongruity or inconsistency between the reported information on the return and the IRS records, we will get immediate feedback on that and corrections can be made immediately." The VITA program has been operating since February 9, and will continue through April 6. The tax preparation sessions are held from 3-6pm on Wed. and Thur. in Room 214 of the Forsyth building. The sessions will not take place on March 8 and 9, due to spring break. For more information or questions please contact Dr. Roger Lirely at (828) 227-3491. WESTERN NORTH CAROLINA'S BIGGEST COLLEGE NIGHT EVERY THURSDAY NIGHT OPEN FREE Admission Before 11 pm party 9 PM* w/ College I.D. & Membership! 3%, 5O0ICE COLD PITCHERS $1 00 BOTTLE $-| 00 ALL VODKA X« BEER ^X# DRINKS - ALL NIGHT LONG - $1,000 00 CASH/ PRIZES BALLOON DROP FOR THE LADIES! 18 & UP ADMITTED TO PARTY...21 & UP ONLY TO DRINK! - PROPER I.D. AND DRESS REQUIRED - 711 BILTMORE AVE. BEHIND CUTTING EDGE GYM ASHEVILLE, NC • INFO HOTLINE *828) 252-5225

Object

Object’s are ‘parent’ level descriptions to ‘children’ items, (e.g. a book with pages).

-

The Western Carolinian is Western Carolina University's student-run newspaper. The paper was published as the Cullowhee Yodel from 1924 to 1931 before changing its name to The Western Carolinian in 1933.

-