Western Carolina University (20)

View all

- Canton Champion Fibre Company (2308)

- Cherokee Traditions (291)

- Civil War in Southern Appalachia (165)

- Craft Revival (1942)

- Great Smoky Mountains - A Park for America (2857)

- Highlights from Western Carolina University (430)

- Horace Kephart (941)

- Journeys Through Jackson (154)

- LGBTQIA+ Archive of Jackson County (85)

- Oral Histories of Western North Carolina (314)

- Picturing Appalachia (6772)

- Stories of Mountain Folk (413)

- Travel Western North Carolina (160)

- Western Carolina University Fine Art Museum Vitreograph Collection (129)

- Western Carolina University Herbarium (92)

- Western Carolina University: Making Memories (708)

- Western Carolina University Publications (2353)

- Western Carolina University Restricted Electronic Theses and Dissertations (146)

- Western North Carolina Regional Maps (71)

- World War II in Southern Appalachia (131)

University of North Carolina Asheville (6)

View all

- Allanstand Cottage Industries (62)

- Appalachian National Park Association (53)

- Bennett, Kelly, 1890-1974 (1388)

- Berry, Walter (76)

- Brasstown Carvers (40)

- Carver, George Washington, 1864?-1943 (26)

- Cathey, Joseph, 1803-1874 (1)

- Champion Fibre Company (233)

- Champion Paper and Fibre Company (297)

- Cherokee Indian Fair Association (16)

- Cherokee Language Program (22)

- Crowe, Amanda (40)

- Edmonston, Thomas Benton, 1842-1907 (7)

- Ensley, A. L. (Abraham Lincoln), 1865-1948 (275)

- Fromer, Irving Rhodes, 1913-1994 (70)

- George Butz (BFS 1907) (46)

- Goodrich, Frances Louisa (120)

- Grant, George Alexander, 1891-1964 (96)

- Heard, Marian Gladys (60)

- Kephart, Calvin, 1883-1969 (15)

- Kephart, Horace, 1862-1931 (313)

- Kephart, Laura, 1862-1954 (39)

- Laney, Gideon Thomas, 1889-1976 (439)

- Masa, George, 1881-1933 (61)

- McElhinney, William Julian, 1896-1953 (44)

- Niggli, Josephina, 1910-1983 (10)

- North Carolina Park Commission (105)

- Osborne, Kezia Stradley (9)

- Owens, Samuel Robert, 1918-1995 (11)

- Penland Weavers and Potters (36)

- Roberts, Vivienne (15)

- Roth, Albert, 1890-1974 (142)

- Schenck, Carl Alwin, 1868-1955 (1)

- Sherrill's Photography Studio (2565)

- Southern Highland Handicraft Guild (127)

- Southern Highlanders, Inc. (71)

- Stalcup, Jesse Bryson (46)

- Stearns, I. K. (213)

- Thompson, James Edward, 1880-1976 (226)

- United States. Indian Arts and Crafts Board (130)

- USFS (683)

- Vance, Zebulon Baird, 1830-1894 (1)

- Weaver, Zebulon, 1872-1948 (58)

- Western Carolina College (230)

- Western Carolina Teachers College (282)

- Western Carolina University (1840)

- Western Carolina University. Mountain Heritage Center (18)

- Whitman, Walt, 1819-1892 (10)

- Wilburn, Hiram Coleman, 1880-1967 (73)

- Williams, Isadora (3)

- Cain, Doreyl Ammons (0)

- Crittenden, Lorraine (0)

- Rhodes, Judy (0)

- Smith, Edward Clark (0)

- Appalachian Region, Southern (2569)

- Asheville (N.C.) (1923)

- Avery County (N.C.) (26)

- Blount County (Tenn.) (169)

- Buncombe County (N.C.) (1672)

- Cherokee County (N.C.) (283)

- Clay County (N.C.) (555)

- Graham County (N.C.) (233)

- Great Smoky Mountains National Park (N.C. and Tenn.) (519)

- Haywood County (N.C.) (3567)

- Henderson County (N.C.) (70)

- Jackson County (N.C.) (4740)

- Knox County (Tenn.) (31)

- Knoxville (Tenn.) (12)

- Lake Santeetlah (N.C.) (10)

- Macon County (N.C.) (420)

- Madison County (N.C.) (215)

- McDowell County (N.C.) (39)

- Mitchell County (N.C.) (132)

- Polk County (N.C.) (35)

- Qualla Boundary (981)

- Rutherford County (N.C.) (76)

- Swain County (N.C.) (2117)

- Transylvania County (N.C.) (270)

- Watauga County (N.C.) (12)

- Waynesville (N.C.) (84)

- Yancey County (N.C.) (72)

- Aerial Photographs (3)

- Aerial Views (60)

- Albums (books) (4)

- Articles (1)

- Artifacts (object Genre) (228)

- Bibliographies (1)

- Biography (general Genre) (2)

- Cards (information Artifacts) (38)

- Clippings (information Artifacts) (191)

- Crafts (art Genres) (622)

- Depictions (visual Works) (21)

- Design Drawings (1)

- Drawings (visual Works) (184)

- Envelopes (73)

- Facsimiles (reproductions) (1)

- Fiction (general Genre) (4)

- Financial Records (12)

- Fliers (printed Matter) (67)

- Glass Plate Negatives (381)

- Guidebooks (2)

- Internegatives (10)

- Interviews (815)

- Land Surveys (102)

- Letters (correspondence) (1013)

- Manuscripts (documents) (618)

- Maps (documents) (177)

- Memorandums (25)

- Minutes (administrative Records) (59)

- Negatives (photographs) (5926)

- Newsletters (1285)

- Newspapers (2)

- Occupation Currency (1)

- Paintings (visual Works) (1)

- Pen And Ink Drawings (1)

- Periodicals (193)

- Personal Narratives (10)

- Photographs (12976)

- Plans (maps) (1)

- Poetry (5)

- Portraits (4535)

- Postcards (329)

- Programs (documents) (151)

- Publications (documents) (2305)

- Questionnaires (65)

- Scrapbooks (282)

- Sheet Music (2)

- Slides (photographs) (402)

- Songs (musical Compositions) (2)

- Sound Recordings (796)

- Specimens (92)

- Speeches (documents) (15)

- Tintypes (photographs) (8)

- Transcripts (322)

- Video Recordings (physical Artifacts) (23)

- Vitreographs (129)

- Text Messages (0)

- A.L. Ensley Collection (275)

- Appalachian Industrial School Records (7)

- Appalachian National Park Association Records (336)

- Axley-Meroney Collection (2)

- Bayard Wootten Photograph Collection (20)

- Bethel Rural Community Organization Collection (7)

- Blumer Collection (5)

- C.W. Slagle Collection (20)

- Canton Area Historical Museum (2110)

- Carlos C. Campbell Collection (373)

- Cataloochee History Project (64)

- Cherokee Studies Collection (4)

- Daisy Dame Photograph Album (5)

- Daniel Boone VI Collection (1)

- Doris Ulmann Photograph Collection (112)

- Elizabeth H. Lasley Collection (1)

- Elizabeth Woolworth Szold Fleharty Collection (4)

- Frank Fry Collection (95)

- George Masa Collection (173)

- Gideon Laney Collection (452)

- Hazel Scarborough Collection (2)

- Hiram C. Wilburn Papers (28)

- Historic Photographs Collection (236)

- Horace Kephart Collection (861)

- Humbard Collection (33)

- Hunter and Weaver Families Collection (1)

- I. D. Blumenthal Collection (4)

- Isadora Williams Collection (4)

- Jesse Bryson Stalcup Collection (47)

- Jim Thompson Collection (224)

- John B. Battle Collection (7)

- John C. Campbell Folk School Records (80)

- John Parris Collection (6)

- Judaculla Rock project (2)

- Kelly Bennett Collection (1407)

- Love Family Papers (11)

- Major Wiley Parris Civil War Letters (3)

- Map Collection (12)

- McFee-Misemer Civil War Letters (34)

- Mountain Heritage Center Collection (4)

- Norburn - Robertson - Thomson Families Collection (44)

- Pauline Hood Collection (7)

- Pre-Guild Collection (2)

- Qualla Arts and Crafts Mutual Collection (12)

- R.A. Romanes Collection (681)

- Rosser H. Taylor Collection (1)

- Samuel Robert Owens Collection (94)

- Sara Madison Collection (144)

- Sherrill Studio Photo Collection (2558)

- Smoky Mountains Hiking Club Collection (616)

- Stories of Mountain Folk - Radio Programs (374)

- The Reporter, Western Carolina University (510)

- Venoy and Elizabeth Reed Collection (16)

- WCU Gender and Sexuality Oral History Project (32)

- WCU Mountain Heritage Center Oral Histories (25)

- WCU Oral History Collection - Mountain People, Mountain Lives (71)

- WCU Students Newspapers Collection (1784)

- Western North Carolina Tomorrow Black Oral History Project (69)

- William Williams Stringfield Collection (2)

- Zebulon Weaver Collection (109)

- African Americans (390)

- Appalachian Trail (35)

- Artisans (521)

- Cherokee art (84)

- Cherokee artists -- North Carolina (10)

- Cherokee language (21)

- Cherokee pottery (101)

- Cherokee women (208)

- Church buildings (170)

- Civilian Conservation Corps (U.S.) (110)

- College student newspapers and periodicals (1876)

- Dams (107)

- Dance (1023)

- Education (222)

- Floods (61)

- Folk music (1015)

- Forced removal, 1813-1903 (2)

- Forest conservation (220)

- Forests and forestry (1184)

- Gender nonconformity (4)

- Great Smoky Mountains National Park (N.C. and Tenn.) (181)

- Hunting (45)

- Landscape photography (25)

- Logging (118)

- Maps (83)

- Mines and mineral resources (8)

- North Carolina -- Maps (18)

- Paper industry (38)

- Postcards (255)

- Pottery (135)

- Railroad trains (71)

- Rural electrification -- North Carolina, Western (3)

- School integration -- Southern States (2)

- Segregation -- North Carolina, Western (5)

- Slavery (5)

- Sports (452)

- Storytelling (243)

- Waterfalls -- Great Smoky Mountains (N.C. and Tenn.) (66)

- Weaving -- Appalachian Region, Southern (280)

- Wood-carving -- Appalachian Region, Southern (328)

- World War, 1939-1945 (173)

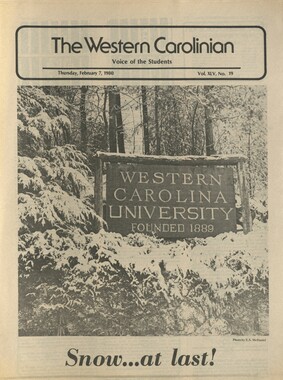

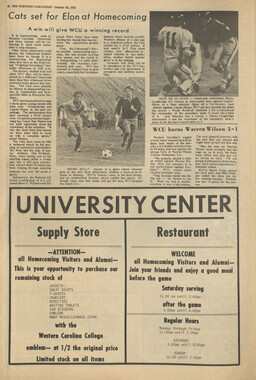

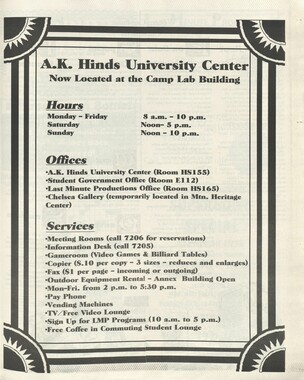

Western Carolinian Volume 67 Number 09

Item

Item’s are ‘child’ level descriptions to ‘parent’ objects, (e.g. one page of a whole book).

-

-

ewsmagazine wc Inoney the back page By: Lee Schwarz I WCnewsmagazine Roth Funds: Be Able to Retire with Virility In 1998, Senator Roth proposed a tax-free retirement option for Americans. He proposed a Roth IRA (Independent Retirement Account). There are two types of IRA's: traditional and Roth. The advantage of the Roth fund is that it allows you to collect all of your money when you are 59 h-years-old, again free of tax. You can contribute up to $3000 a year to a Roth fund. You are allowed to withdraw the money that you have put into a Roth fund tax-free, but the catch is that you cannot withdraw the interest your money has accrued tax-free. Once you withdraw the money you have contributed to your Roth, you cannot put it back into the Roth fund. Think of a Roth fund as a "shell. " Whatever is in the "shell" is tax-free. You can buy stocks, bonds, or even mutual funds and put them into your tax-free "shell. " Make sure that you pick a fairly stable security because once you have invested, you should plan to be in that stock for a long time. Securities tend to reward investors who are faithful, patient, and own that particular security for an extended period of time. When you are 59 h, you can stop working if you want to and tell your boss to kiss, well, whatever, if you want. This freedom is available only to those invest wisely for their retirements while they are young. I don't want to work for someone else when I am 60. I want to either be retired or still running my own business if it gives me joy. Plan now for retirement, and take care of it for yourself. I am not counting on social security being available when I am 65 and neither should you. The Schwarz Factor Over the long "haul" I am going to show you what can be available to you when you are 59 h, if you invest in a Roth. What we will be looking at is the F VA (Future Value of Annuity) table. If you begin investing at 18, and you contribute $3000 a year for 41 years until you are 59 1/2 and you invest at 15%, you will have $6, 140,861.70. That much money will allow you to tell most people to kiss your whatever.• l.schwarz nycÆicoco'eo October 2dd2 1 WCnew$rnågaiine (AUgust23T- SeptembeH22)t Youare goiåg 'to be Seeing changeSi0Object

Object’s are ‘parent’ level descriptions to ‘children’ items, (e.g. a book with pages).

-

The Western Carolinian is Western Carolina University's student-run newspaper. The paper was published as the Cullowhee Yodel from 1924 to 1931 before changing its name to The Western Carolinian in 1933.

-

-