Western Carolina University (21)

View all

- Canton Champion Fibre Company (2308)

- Cherokee Traditions (291)

- Civil War in Southern Appalachia (165)

- Craft Revival (1942)

- George Masa Collection (137)

- Great Smoky Mountains - A Park for America (3080)

- Highlights from Western Carolina University (422)

- Horace Kephart (973)

- Journeys Through Jackson (159)

- LGBTQIA+ Archive of Jackson County (89)

- Oral Histories of Western North Carolina (318)

- Picturing Appalachia (6617)

- Stories of Mountain Folk (413)

- Travel Western North Carolina (153)

- Western Carolina University Fine Art Museum Vitreograph Collection (129)

- Western Carolina University Herbarium (92)

- Western Carolina University: Making Memories (738)

- Western Carolina University Publications (2491)

- Western Carolina University Restricted Electronic Theses and Dissertations (146)

- Western North Carolina Regional Maps (71)

- World War II in Southern Appalachia (131)

University of North Carolina Asheville (6)

View all

- Allanstand Cottage Industries (62)

- Appalachian National Park Association (53)

- Bennett, Kelly, 1890-1974 (1463)

- Berry, Walter (76)

- Brasstown Carvers (40)

- Carver, George Washington, 1864?-1943 (26)

- Cathey, Joseph, 1803-1874 (1)

- Champion Fibre Company (233)

- Champion Paper and Fibre Company (297)

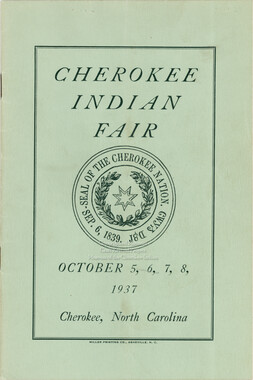

- Cherokee Indian Fair Association (16)

- Cherokee Language Program (22)

- Crowe, Amanda (40)

- Edmonston, Thomas Benton, 1842-1907 (7)

- Ensley, A. L. (Abraham Lincoln), 1865-1948 (275)

- Fromer, Irving Rhodes, 1913-1994 (70)

- George Butz (BFS 1907) (46)

- Goodrich, Frances Louisa (120)

- Grant, George Alexander, 1891-1964 (96)

- Heard, Marian Gladys (60)

- Kephart, Calvin, 1883-1969 (15)

- Kephart, Horace, 1862-1931 (313)

- Kephart, Laura, 1862-1954 (67)

- Laney, Gideon Thomas, 1889-1976 (439)

- Masa, George, 1881-1933 (61)

- McElhinney, William Julian, 1896-1953 (44)

- Niggli, Josephina, 1910-1983 (10)

- North Carolina Park Commission (105)

- Osborne, Kezia Stradley (9)

- Owens, Samuel Robert, 1918-1995 (11)

- Penland Weavers and Potters (36)

- Roberts, Vivienne (15)

- Roth, Albert, 1890-1974 (142)

- Schenck, Carl Alwin, 1868-1955 (1)

- Sherrill's Photography Studio (2565)

- Southern Highland Handicraft Guild (127)

- Southern Highlanders, Inc. (71)

- Stalcup, Jesse Bryson (46)

- Stearns, I. K. (213)

- Thompson, James Edward, 1880-1976 (226)

- United States. Indian Arts and Crafts Board (130)

- USFS (683)

- Vance, Zebulon Baird, 1830-1894 (1)

- Weaver, Zebulon, 1872-1948 (58)

- Western Carolina College (230)

- Western Carolina Teachers College (282)

- Western Carolina University (2008)

- Western Carolina University. Mountain Heritage Center (18)

- Whitman, Walt, 1819-1892 (10)

- Wilburn, Hiram Coleman, 1880-1967 (73)

- Williams, Isadora (3)

- Cain, Doreyl Ammons (0)

- Crittenden, Lorraine (0)

- Rhodes, Judy (0)

- Smith, Edward Clark (0)

- Appalachian Region, Southern (3032)

- Asheville (N.C.) (1945)

- Avery County (N.C.) (26)

- Blount County (Tenn.) (195)

- Buncombe County (N.C.) (1680)

- Cherokee County (N.C.) (283)

- Clay County (N.C.) (556)

- Graham County (N.C.) (238)

- Great Smoky Mountains National Park (N.C. and Tenn.) (525)

- Haywood County (N.C.) (3573)

- Henderson County (N.C.) (70)

- Jackson County (N.C.) (4925)

- Knox County (Tenn.) (35)

- Knoxville (Tenn.) (13)

- Lake Santeetlah (N.C.) (10)

- Macon County (N.C.) (421)

- Madison County (N.C.) (216)

- McDowell County (N.C.) (39)

- Mitchell County (N.C.) (135)

- Polk County (N.C.) (35)

- Qualla Boundary (982)

- Rutherford County (N.C.) (78)

- Swain County (N.C.) (2185)

- Transylvania County (N.C.) (270)

- Watauga County (N.C.) (12)

- Waynesville (N.C.) (86)

- Yancey County (N.C.) (72)

- Aerial Photographs (3)

- Aerial Views (60)

- Albums (books) (4)

- Articles (1)

- Artifacts (object Genre) (228)

- Bibliographies (1)

- Biography (general Genre) (2)

- Cards (information Artifacts) (38)

- Clippings (information Artifacts) (192)

- Copybooks (instructional Materials) (3)

- Crafts (art Genres) (622)

- Depictions (visual Works) (21)

- Design Drawings (1)

- Digital Moving Image Formats (2)

- Drawings (visual Works) (185)

- Envelopes (101)

- Exhibitions (events) (1)

- Facsimiles (reproductions) (1)

- Fiction (general Genre) (4)

- Financial Records (12)

- Fliers (printed Matter) (67)

- Glass Plate Negatives (381)

- Guidebooks (2)

- Internegatives (10)

- Interviews (823)

- Land Surveys (102)

- Letters (correspondence) (1045)

- Manuscripts (documents) (618)

- Maps (documents) (177)

- Memorandums (25)

- Minutes (administrative Records) (59)

- Negatives (photographs) (6090)

- Newsletters (1290)

- Newspapers (2)

- Notebooks (8)

- Occupation Currency (1)

- Paintings (visual Works) (1)

- Pen And Ink Drawings (1)

- Periodicals (194)

- Personal Narratives (10)

- Photographs (12977)

- Plans (maps) (1)

- Poetry (6)

- Portraits (4568)

- Postcards (329)

- Programs (documents) (181)

- Publications (documents) (2444)

- Questionnaires (65)

- Relief Prints (26)

- Sayings (literary Genre) (1)

- Scrapbooks (282)

- Sheet Music (2)

- Slides (photographs) (402)

- Songs (musical Compositions) (2)

- Sound Recordings (802)

- Specimens (92)

- Speeches (documents) (18)

- Tintypes (photographs) (8)

- Transcripts (329)

- Text Messages (0)

- A.L. Ensley Collection (275)

- Appalachian Industrial School Records (7)

- Appalachian National Park Association Records (336)

- Axley-Meroney Collection (2)

- Bayard Wootten Photograph Collection (20)

- Bethel Rural Community Organization Collection (7)

- Blumer Collection (5)

- C.W. Slagle Collection (20)

- Canton Area Historical Museum (2110)

- Carlos C. Campbell Collection (462)

- Cataloochee History Project (64)

- Cherokee Studies Collection (4)

- Daisy Dame Photograph Album (5)

- Daniel Boone VI Collection (1)

- Doris Ulmann Photograph Collection (112)

- Elizabeth H. Lasley Collection (1)

- Elizabeth Woolworth Szold Fleharty Collection (4)

- Frank Fry Collection (95)

- George Masa Collection (173)

- Gideon Laney Collection (452)

- Hazel Scarborough Collection (2)

- Hiram C. Wilburn Papers (28)

- Historic Photographs Collection (236)

- Horace Kephart Collection (861)

- Humbard Collection (33)

- Hunter and Weaver Families Collection (1)

- I. D. Blumenthal Collection (4)

- Isadora Williams Collection (4)

- Jesse Bryson Stalcup Collection (47)

- Jim Thompson Collection (224)

- John B. Battle Collection (7)

- John C. Campbell Folk School Records (80)

- John Parris Collection (6)

- Judaculla Rock project (2)

- Kelly Bennett Collection (1482)

- Love Family Papers (11)

- Major Wiley Parris Civil War Letters (3)

- Map Collection (12)

- McFee-Misemer Civil War Letters (34)

- Mountain Heritage Center Collection (4)

- Norburn - Robertson - Thomson Families Collection (44)

- Pauline Hood Collection (7)

- Pre-Guild Collection (2)

- Qualla Arts and Crafts Mutual Collection (12)

- R.A. Romanes Collection (681)

- Rosser H. Taylor Collection (1)

- Samuel Robert Owens Collection (94)

- Sara Madison Collection (144)

- Sherrill Studio Photo Collection (2558)

- Smoky Mountains Hiking Club Collection (616)

- Stories of Mountain Folk - Radio Programs (374)

- The Reporter, Western Carolina University (510)

- Venoy and Elizabeth Reed Collection (16)

- WCU Gender and Sexuality Oral History Project (36)

- WCU Mountain Heritage Center Oral Histories (25)

- WCU Oral History Collection - Mountain People, Mountain Lives (71)

- WCU Students Newspapers Collection (1923)

- Western North Carolina Tomorrow Black Oral History Project (69)

- William Williams Stringfield Collection (2)

- Zebulon Weaver Collection (109)

- African Americans (390)

- Appalachian Trail (35)

- Artisans (521)

- Cherokee art (84)

- Cherokee artists -- North Carolina (10)

- Cherokee language (21)

- Cherokee pottery (101)

- Cherokee women (208)

- Church buildings (190)

- Civilian Conservation Corps (U.S.) (111)

- College student newspapers and periodicals (2012)

- Dams (108)

- Dance (1023)

- Education (222)

- Floods (63)

- Folk music (1015)

- Forced removal, 1813-1903 (2)

- Forest conservation (220)

- Forests and forestry (1198)

- Gender nonconformity (4)

- Great Smoky Mountains National Park (N.C. and Tenn.) (181)

- Hunting (47)

- Landscape photography (25)

- Logging (122)

- Maps (83)

- Mines and mineral resources (9)

- North Carolina -- Maps (18)

- Paper industry (38)

- Postcards (255)

- Pottery (135)

- Railroad trains (72)

- Rural electrification -- North Carolina, Western (3)

- School integration -- Southern States (2)

- Segregation -- North Carolina, Western (5)

- Slavery (5)

- Sports (452)

- Storytelling (243)

- Waterfalls -- Great Smoky Mountains (N.C. and Tenn.) (66)

- Weaving -- Appalachian Region, Southern (280)

- Wood-carving -- Appalachian Region, Southern (328)

- World War, 1939-1945 (173)

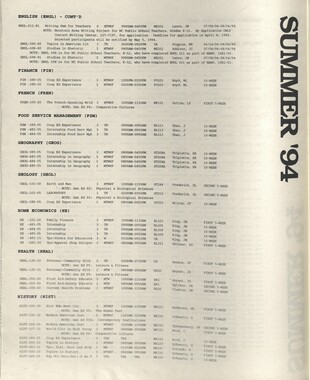

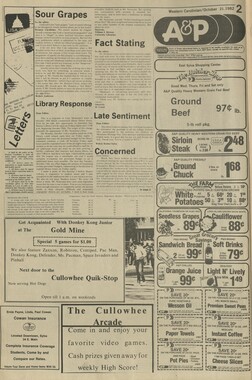

Western Carolinian Volume 80 Number 03

Item

Item’s are ‘child’ level descriptions to ‘parent’ objects, (e.g. one page of a whole book).

-

-

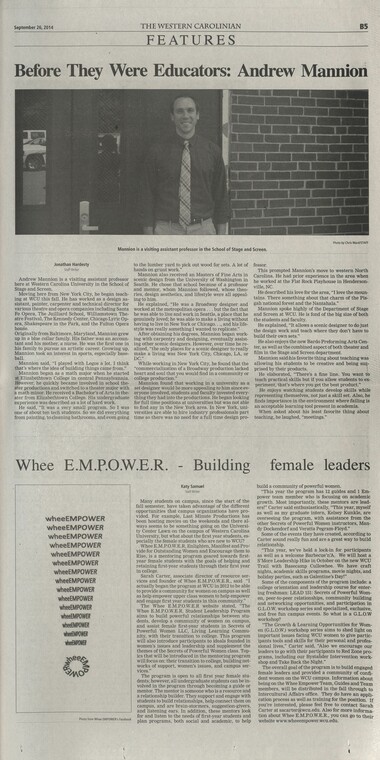

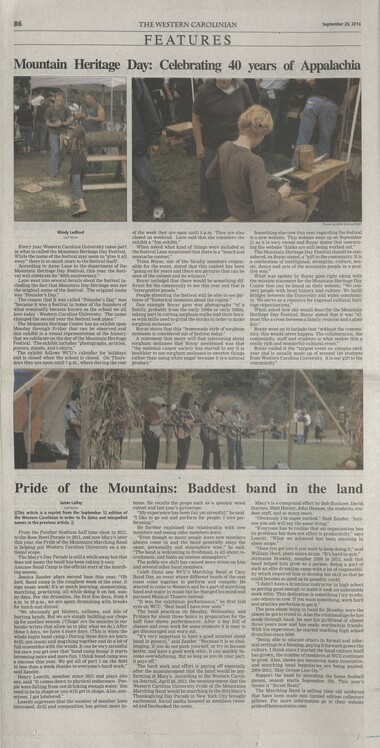

September 26, 2014 THE WESTERN CAROLINIAN AS EDITORIAL What Tabitha Price - Staff Writer [[Price was asked to write an editorial about what Western C arolina University meant to her. As a result she talked about many things that drew her to the university and the things that kept her here. Sometimes a cluster of buildings can mean more than concrete and brick.]] As a timid freshman in high school I thought of col- lege as a distant experience that was exciting to think about but also as one that I would never have in a mil- lion years. I figured I would just graduate and live job-to-job, paycheck-to-paycheck as the rest of my family had. done. In other words, I figured I would join the strug- gle to survive that had spanned generations. We were not fancy college people, after all. My living situation was constantly unstable throughout high school and at times I supported my family financially more than they supported me. I could not see myself living any other way. I shied away from the conversations my peers would have about the money their parents had put back for them wCuU means Photo Submitted By Tabitha Price/STAFF or how they planned to go to the same school that their parents did. I had nothing to contribute. I suppose more than anything I felt stuck. Talso felt as ifI was not fit to do anything more than struggle, and at the age of 16 I was already dreading the rest of my life. Imagine my surprise and disbelief when I made it to my freshman Orenearion the sum- mer after I graduated. Despite being considered a sub-par institution, my -high school promoted a college education to every _ student. I was recommended to join a college prep program that required me to do the work and thus ended up receiving my WCU acceptance letter within a few weeks of applying my senior year. While I was doing all this work for the program 1 constantly thought about how crazy it would be if1 ac- tually made it. Yes, I could be accepted and whatnot, but I wouldnt believe it was reality until I stepped foot on WCUs campus. The night of orientation I distinctly remember sit- ting out at the fountain and thinking this place is my way out, my way out of the struggle, my way out of dread, my way out of the insecurity. I was in awe of WCU from the start. To me it seemed Thus article series hones to serve the Gullowhee area ly ahang students insight mito x % to me so big and so promising. I felt like I could do things differently here, like I could take care of and focus only on myself and even if] didnt get a thriving career from it I could still end up in a better place than where I started. So far I be- lieve I was right. WCU has drastically changed my outlook on my life in general. I have met teachers who have pushed me to use my time here productively by doing things that I thought were beyond my capabilities, such as writ- ing this article for this publication. People who come from places like me do not do that kind of thing, right? Through them I have gained confidence. I awe also met friends who make me want to get up and work every day and who support me while doing it. They have made me realize that a great career and loads of money are not everything. The people who I have grown close to are really what is worthwhile. More than anything, I think being here has taught me that how I perceive my situation determines how positive or negative it is. In high school I thought all my work and struggling would never get me anywhere yet now I am here. J often wonder where I will end up after this, but Im confident that I won't regress or ex- perience total failure. I now think that as long as Im working toward bet- tering myself and as long as I hold onto the belief that Tam indeed not stuck or incapable, I will be just fine. I now have the mindset that struggling wont deter me and it doesnt mean that I am not going anywhere. In retrospect I would hate to think how I would be living if I had not come here. That is not to say that I would find disdain in working in a factory, fast food restaurant, etc. I am currently a McDonalds employee loud and proud, but I know for a fact that I am capable of ob- taining the skills required to do other work that lam more interested in. That confidence is vital to me. I also know now that I have flexibility. If I do not like where I am at, I can move. I am not a tree. ' While I still think of WCU as my way out, I think the connotation of that has now shifted in terms of the struggling aspect. As.I said before, struggling does not mean that Im not going anywhere and I definitely still struggle, each and every day. Now, I would say instead that WCU is my way out of the dread, the inse- curity, and most importantly a toxic mindset. Financial Building Block cw financial sede of adulthood, Hank Hodge Staff Writer Millennials may think theyre staying out of fi- nancial trouble by forgoing credit cards, but theyre actually doing a disservice to themselves and their credit scores, said Jeanine Skowronski, Bankrate. coms credit card analyst. The responsible use of credit cards is one of the easiest ways to build a strong credit score, which is essential for qualifying for insurance policies, auto and mortgage loans, and sometimes even a job. You may have heard of a credit score but may not be aware about how much it may affect you and your financial future. If you are like most people at some point in your life you are going to consider making a large purchase, such as a home or automobile, and to do so you are going to need to borrow money from a bank or other lender. Banks take a risk every time they lend money but they want to feel confident that the customers they are lending to are credible, trustworthy and have the ability to repay their loan on time and in full. Keep in mind that a lender may be meeting you for the first time and will not know anything about you or your fi- nancial habits. Your credit report will give the lender a snapshot of your financial life. Your credit score is a number which has been cre- ated to help lenders make accurate and reliable cred- it decisions. The most common risk based score is known asa FICO score. In short, it shows how respon- sible or irresponsible you have been with your finan- cial obligations. FICO scores range from 350 to 850. The higher the score the better. According to myfico.com a score of 680 or higher would generally be considered good, with the national average being around 692. A credit score less than 650 is considered subprime and may disqualify you for a loan or credit card or at best will result in a higher interest rate. There are five areas that affect your credit score that we, as credit builders, have control over. The first is payment history which accounts for 35% of your to- tal score. Not just credit card payments, but all bills. Creditors want to know that you pay on time, every time, even if it is just the minimum. Consistency is key so it is important to get in the habit now of always paying your bills when theyre due and never skip a payment. The second portion of your credit score is based on how much debt you have and this accounts for 30% of your score. According to experts its a good rule of thumb to keep your overall debt lower than the over- all credit available. The lower the better. The third factor that determines your credit score is your credit history which accounts for 15% of your score. That is, how long you have had credit avail- able to you and how responsibly you have managed it. This one is intuitive, if you were to lend somebody money you would want to know if they are in the habit of paying on time and in full. A fourth factor accounts for 10% of your score and examines different types of credit in your name, such as credit cards, cell phone payments, car loans, etc. Creditors look into this area because it proves you have experience handling a variety of account types and have been successful in managing them. The fifth scoring criteria is new credit inquires which make up the final 10% of your score. Creditors as part of their own credit policy evaluate your credit . inquires with other institutions. Creditors will look at recently opened accounts and where you have ap- plied for credit. They want to determine whether you have obtained more liabilities than you can repay. Credit scores are a fairly accurate method of deter- mining your financial credit worthiness and their use is likely to be expanded in the future. Once you have an exceptional and established cred- it score guard it with your life. Your score depends on the accuracy of your credit reports and there are three national credit-reporting bureaus: Experian, TransUnion and Equifax. Youre entitled to a free credit report from each of them every year, which you can request from AnnualCreditReport.com. Re- view these reports carefully and dont be afraid to ask questions about anything that is inaccurate. Mis- takes do happen. Remember this - You are going to acquire a credit score whether you want to or not. Knowing this you should attempt to influence your credit score at ev- ery opportunity acquiring credit, handling credit responsibly, and paying all bills on time are all things that will assist you in your financial future. !

Object

Object’s are ‘parent’ level descriptions to ‘children’ items, (e.g. a book with pages).

-

The Western Carolinian is Western Carolina University's student-run newspaper. The paper was published as the Cullowhee Yodel from 1924 to 1931 before changing its name to The Western Carolinian in 1933.

-